Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn more If you’ve already read Part 1, measuring your team’s crime-fighting ability, then welcome back! If this is your first post, you’ll probably want to pause a sec and read Part 1 first.

A lot has happened since I published the first of this series, including a worldwide pandemic. But I’ve already seen a growing number of articles reach headlines that talk about criminal scams. Sadly, criminals don’t seem to be pausing their efforts.

If you’ve already read Part 1, measuring your team’s crime-fighting ability, then welcome back! If this is your first post, you’ll probably want to pause a sec and read Part 1 first.

A lot has happened since I published the first of this series, including a worldwide pandemic. But I’ve already seen a growing number of articles reach headlines that talk about criminal scams. Sadly, criminals don’t seem to be pausing their efforts.

Just to recap, you can and should measure your team’s AML (Anti-Money Laundering) effectiveness. And I’ve split the KPIs (Key Performance Indicators) I’ve learned along the way into 4 pillars.

- Crime-fighting

- Customer Impact (this post)

- Cost

- Compliance

There’s a tiny voice deep down inside me that worries many corporations stopped caring long ago about how their actions affect customers — but hopefully I’m wrong. Because, to me, next to catching criminals, protecting your customer base from undue harm is the next highest priority.

The good news, at least for those working in AML, is that because your work touches far less than those on the frontlines in KYC or Verification, your overall customer impact is often lower. But customer impact can still happen, especially if you end up taking longer than a customer expects to investigate an alert that’s popped up on their account. I’ve read through scores of poor reviews, and there’s nothing that can make you feel worse than to read the helplessness and anger that good customers feel when they cannot access their funds and aren’t getting the answers they want from your company.

I’ll cover 3 main areas you can measure.

- Average payment suspension time for good customers

- Drop-off due to compliance reasons

- Your team’s invisibility

Average payment suspension time for good customers

KPI 1: Average / median alert resolution time

How long did good customers have to wait for their payments to be released? (E.g. the median customer wait time is 2 weeks.)

Imagine Sam, one of your longtime customers, has finally found the flat of his dreams in a country where he wants to move, but the owner is impatient to sell. He’s never bought real estate before but Sam isn’t worried — he’s been saving for years. He logs into his online account and transfers his down payment. Hold up, though! Sam’s transaction triggers a few rules your team has set in place and, as a result, you’ve put his transfer on hold until someone from your team can check.

Now, if your team’s backlog is hundreds and hundreds of payments and you can’t check Sam’s transfer for a few weeks, then poor Sam may lose out on his dream flat because another potential buyer can get her down payment to the flat owner faster. And, if you were Sam, you’d be pretty upset at your bank right about now.

This is exactly the type of customer impact it’s important for your team to measure. You can measure it by the average customer wait time. Or by the size of your backlog.

KPI 2: Length / size of your team’s backlog

How long is your current backlog? How has it changed over time?

This goes hand in hand with the previous KPI. It’s just another way to measure how long your good customers need to wait but is more centralised to your team’s operations.

Drop-off due to compliance reasons

Discouraging potentially good customers from using your company can happen in 2 main ways.

- By requests for additional information after you’ve suspended a transaction.

- By requests for information during transaction setup.

But there are a few ways you can measure this, in both the negative and the positive.

KPI 3: Cancellation rate of alerted transactions

How many customers gave up because you asked for too much information?

Let’s go back to Sam’s transaction. Within a few hours of being alerted, maybe you send him an email asking for a document showing his source of wealth, information about the property he’s buying, etc. Normal questions. But Sam is in a hurry, and it turns out he actually has enough money at another financial institute. So instead of sending you the documents your team requested, he just cancels his transfer and uses an account he has at another bank. This happens a lot. Though you can’t prevent this 100% of the time, you can reduce the amount of time it happens by optimising how and when you ask for information.

KPI 4: Percent of alerts resolved online/automatically in less than 5 minutes

How many alerts were resolved before your team had to check them?

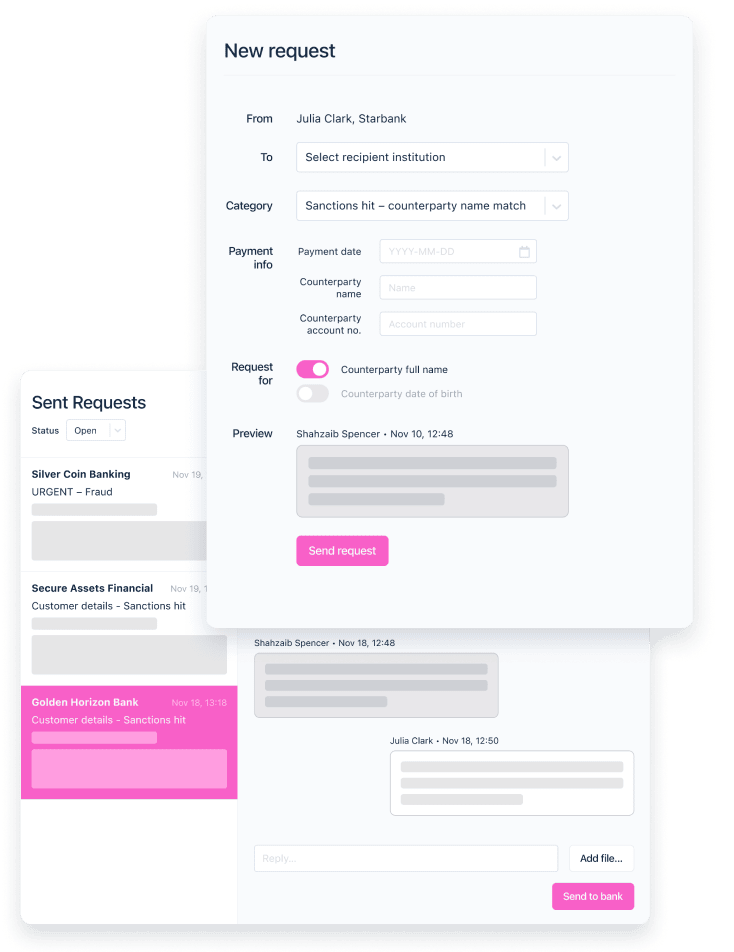

There’s another way you can measure the same issue, but in the positive. But let’s look at a completely different way of requesting information. One option Salv offers business clients is to ask for sanctions info as a customer is setting up a new transaction. The system then recognises a possible sanctions hit and immediately asks your customer for their recipient’s date of birth as they set up their transfer. Now, asking for information this way might cut down on 90% of your sanction team’s workload later. Which sounds incredible. In this case you can measure how many alerts are resolved before your team had to check them.

It’s important to note that some customers abandon the transaction not necessarily because they’re up to something fishy, but because they simply don’t know the requested information. So it’s a risk to ask for information upfront. But you can measure the positive side of how many alerts were resolved quickly — it might paint a picture that shows you’re doing a great service to both your customers and your team at the end of the day.

This next measurable is slightly technical and, frankly, depends on your business model. But it’s common enough that I think it’s worth mentioning.

Your team’s invisibility to the customer

AML should be invisible to customers if at all possible. But there are a few ways you can check to see how true this is for your company.

KPI 5: Instant payments delayed due to compliance checks

How many instant payments were slowed down because running AML checks took too much time?

Let’s say your company is using one of the tried and true AML service providers that have been around for awhile. One thing these tools weren’t likely prioritising is the instant experience because it didn’t exist at the tie. So the fact that it took a rule or a control 10-30 seconds to run on a single transaction wasn’t a big deal.

But, nowadays, with the UK’s FPS (Faster Payments Service) and the EU’s ever-improving SEPA (Single Euro Payments Area), payments — at least in Europe — are frequently moving in seconds these days. And that doesn’t even begin to touch what are now becoming mainstream payment options like ApplePay, Google Pay, regular bank cards, iDeal, BankGiro, and even more across the pond.

This is where old school AML controls can start to spoil your customer experience. Because, all too often, the time it takes for these controls to run may completely eliminate the possibility of your company offering instant payments to your customers. Because, in these cases, running your controls in milliseconds rather than 10 seconds can make a massive customer impact. Giving your customers an instant experience is a huge market advantage. That’s why cross-border payment companies like TransferWise are focusing so intensively on bettering their instant experiences — they went from 15% instant (transfers completed in 20 seconds or less) at the beginning of 2019 to 24% instant payments by the end of 2019.

KPI 6: Percentage of poor reviews related to AML

What percentage of unhappy customers reviewing your company are due to AML?

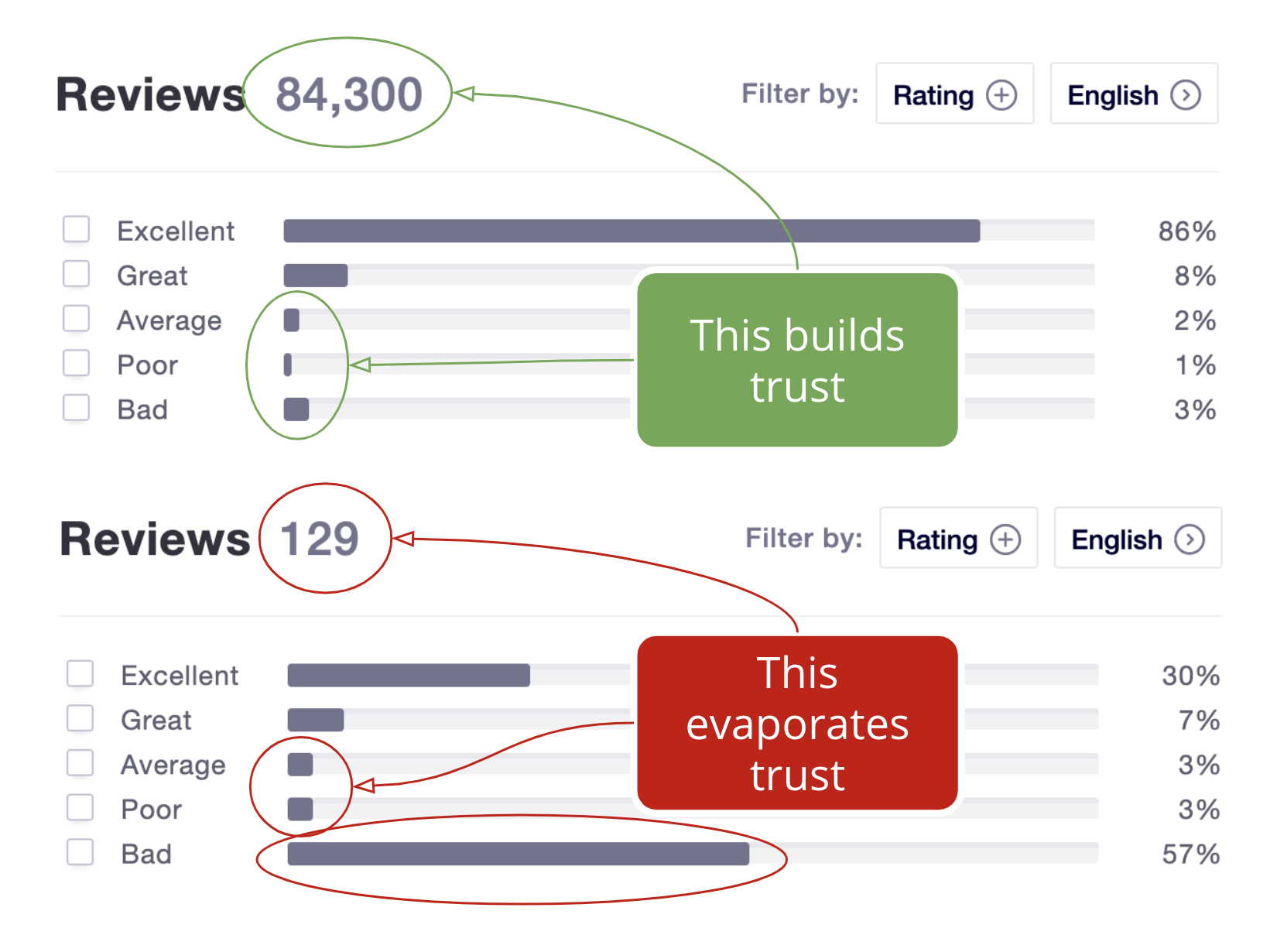

This is an area that we at Salv have specifically started to track. Financial companies increasingly live and die by their online reputations. It makes sense — customers want to know whether they can trust businesses. In Europe at least, if someone googles “fintech-name + reviews” they might quickly land on Trustpilot. What they find will either inspire confidence, or make potential customers run for the hills.

This is part of an actual Trustpilot comparison we did of two growing financial companies.

This is part of an actual Trustpilot comparison we did of two growing financial companies.

The first company above will continue growing. Word-of-mouth alone will propel them forward. Not only that, but because word-of-mouth is free, this will dramatically reduce their customer acquisition costs in addition to customer support. But the second company you see will struggle to grow and put the whole enterprise in jeopardy.

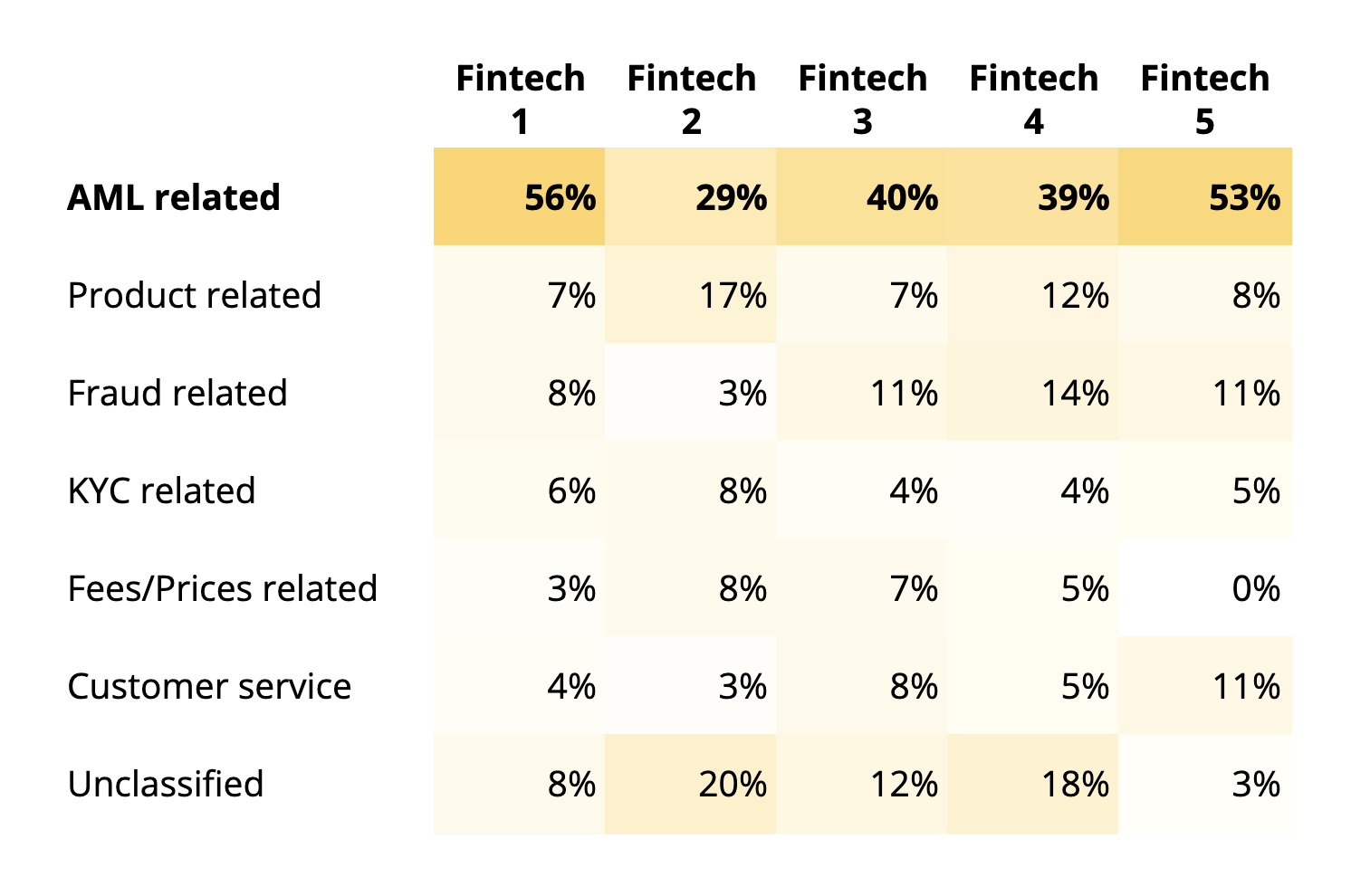

So what does this have to do with AML? At Salv, we’ve been digging into the numbers and it turns out, for far too many financial companies, that a lot of the negative reviews are related to AML. When I say a lot, I’m not exaggerating. For 5 large fintechs we looked at recently, it’s by far the top reason. Typically, negative AML reviews are 2-5x larger than any other category of customer gripe — including product challenges, price, and customer support.

But the silver lining in all of this is that companies of all sizes have a massive opportunity to improve their online reputations just by improving their AML processes and tooling.

Summing up your customer impact AML metrics

These KPIs are just a few examples of how you can measure your AML impact on them.

Average payment suspension time for good customers

- Average / median alert resolution time

- Length / size of your team’s backlog

Drop-off due to compliance reasons

- Cancellation rate of alerted transactions

- Percent of alerts resolved online/automatically in less than 5 minutes

Your team’s invisibility to the customer

- Instant payments delayed due to compliance checks

- Percentage of poor reviews related to AML

Our customers are our lifeblood, and they are why many of our businesses got started in the first place. It will always be important to try and make sure we’re doing as little damage to them as possible, all the while keeping crime in check.

Next post? The second-most common type of AML KPIs. Cost.