Salv Bridge

Send and receive fraud and AML intelligence with other financial institutions

You want to collaborate. But the blockers are real.

Salv Bridge removes the operational, regulatory, and technical barriers that get in the way.

Finally, there’s an easy, instant way to communicate with other financial crime teams.

Financial crime happens fast, but communication doesn’t

As stolen money moves between financial institutions, investigations fall apart.

Communication between financial crime teams is slow, messy, and inconsistent.

That’s a problem — because other institutions hold the missing context you need.

Salv Bridge changes that. It makes communicating with other fincrime teams fast, focused, and secure.

Suddenly, catching criminals gets much easier.

Salv Bridge makes intelligence sharing simple

Salv Bridge connects financial crime teams across institutions — giving you a fast, compliant way to communicate and share intelligence.

80+ banks and PSPs use Salv Bridge to exchange red flags and other vital intelligence daily.

It’s end-to-end encrypted, works locally and across borders, and is aligned with EU and national laws.

Our partners and clients

Collaborate across fraud, KYC, and AML

Recover fraud losses

Track stolen funds across institutions. Share intelligence fast to recover losses, protect customers and preserve trust.

Salv Bridge helps you to recover funds as they move down the payment chain. It brings together financial institutions into a trusted community and enables communication between fincrime investigation teams.

- One shared channel with advanced encryption

- Collaboration based on a high level of suspicion, not only confirmed fraud

- Web user interface and API integration

You can report potential bad actors to the Salv Bridge network using suspicious entity sharing.

- Proactively share and use the data in investigations

- Request additional context and run real-time checks

- Information available through search query

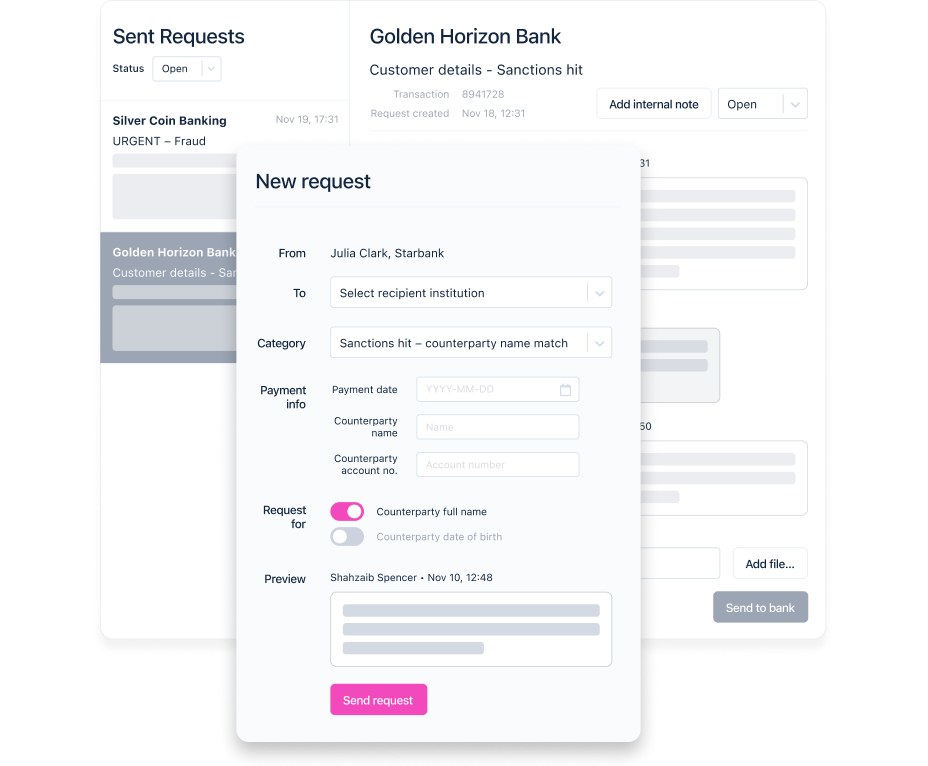

Automate screening RFIs

Speed up sanctions and KYC resolution. Share RFIs automatically — no manual emails or customer friction.

Whatever tooling you are using, there will always be exact name matches amongst screening alerts – can’t get rid of them. What you can eliminate though, is bothering customers. Get the necessary info from counterparty financial institutions in the network instead.

Detect money mules and suspicious customers

Stay ahead of high-risk behaviour. Get alerts on suspicious customers before harm is done.

Salv Bridge supports public-private partnerships (PPPs). It creates a direct line of communication between financial institutions and law enforcement authorities. Fincrime teams can conduct investigations, enrich data, and report suspicious activities directly to the relevant law enforcement agencies.

Based on the jurisdiction, Salv Bridge can be set up between financial institutions and FIUs, Police, Tax & Customs or other relevant law enforcement authorities involved in financial crime-fighting.

Uncover money laundering networks

Build multi-institution investigations that reveal hidden connections and expose complex laundering schemes.

Identify and investigate suspicious activities related to money laundering while collaborating with partner financial institutions. Your team can now complete complex investigations spanning multiple institutions and resolve missing data gaps way faster than before.

- Ask and receive data from partner institutions

- Collect data in a simple UI where everything is interlinked

Block payments to known fraudsters

Get notified of fraudulent IBANs. Block payments to them and prevent any money reaching criminally-controlled accounts.

Reduce your team’s workload and increase operational efficiency by automating 50% of your RFIs with money service businesses (MSBs).

In around half of the cases, after the money has been stopped and alert raised, the MSBs already have the information you are missing. This allows Salv Bridge to exchange data between your system and their system automatically and fully encrypted.

Having 50% of the simpler, name match RFIs automated frees up time for your team to dig into the complex cases, improving the quality of your compliance team’s work.

Here is how it works

Secure messaging

- Fincrime teams use secure messaging for instant, end-to-end encrypted communication.

- Standardise your investigations by using a templated approach.

- Urgency indicators and notification settings prioritise time-critical messages.

- Your investigations now move faster and are based on higher quality info – win-win.

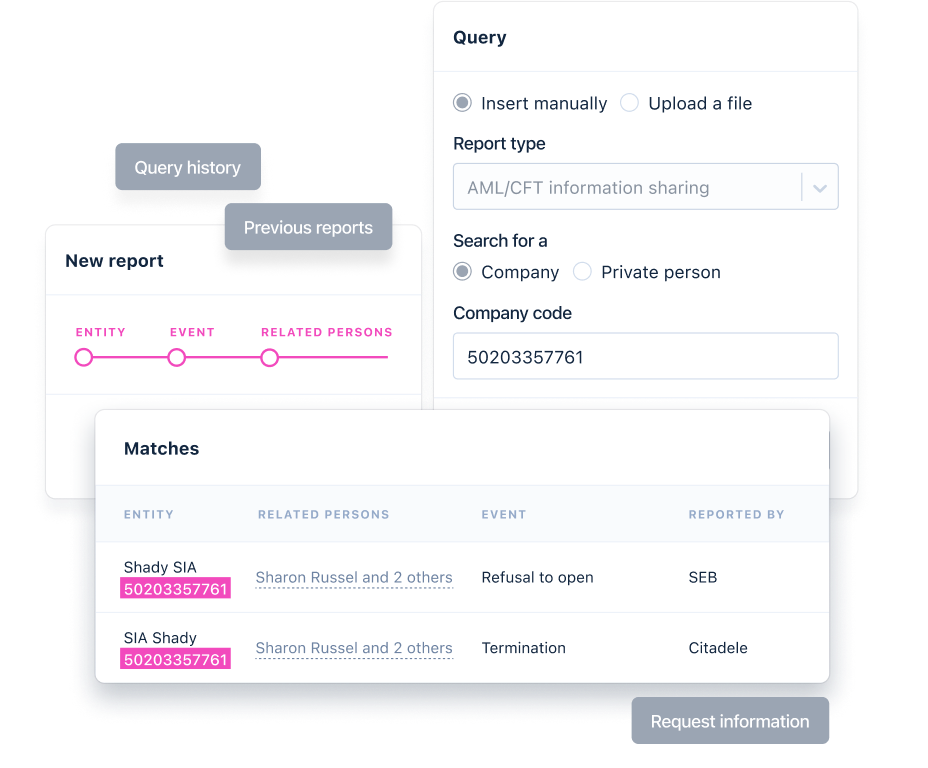

Suspicious entity sharing

- Share and query data on high-risk customers and suspicious counterparties with other network participants.

- Protect your business from shady, full-of-red-flags customers.

- Available in both UI and API format – smooth integration into your existing work processes.

- Better data = better decisions.

With Salv Bridge

you can

- Exchange information in a GDPR-compliant manner.

- Minimise data – only ask and receive data that are needed

- Have a clear audit trail and performance statistics

Client testimonials

Q&A

Salv Bridge is an information and data exchange solution.

Our cloud-based solution enables financial institutions to exchange and enrich data on bad actors, so all parties strengthen their respective AML efforts. Salv Bridge is encrypted and fully-compliant with the latest data protection regulations.

With Salv Bridge, your team can proactively co-operate across borders, across legal jurisdictions, and against transnational criminal networks.

Salv Bridge can be used for:

-

Recovering funds: Proactive communication, collaboration, and trust allow fincrime investigation teams to exchange data and make decisions based on a high level of suspicion and ahead of the victim report. In 2022, our customers report, it led to the recovery of approximately 80% of funds lost to fraud. Read the case study.

-

Joint AML investigations: Collaborate with other financial institutions in a secure unified (templated) way. No more unorganised emails and meetings in the parks. The sooner missing data gaps are closed, the faster and more effective money-laundering and fraud investigations spanning multiple institutions become. User roles function makes sure only eyes which are supposed to see the investigation do so.

-

Screening alerts resolution: There will always be exact name matches amongst screening alerts. Can’t get rid of them. What you can eliminate though, is bothering customers. Get the necessary info from counterparty financial institutions in the network instead.

-

Automated information exchange: As a BaaS company, reduce your team’s workload and increase operational efficiency by automating 50% (the exact name matches) of your RFIs with money service businesses (MSBs).

Complex fincrime schemes happen across multiple institutions, and each only sees one part of the bigger picture. Salv Bridge brings together financial institutions into a trusted community to detect and investigate fraud and money laundering fill in the missing puzzle pieces.

Salv Bridge

- connects financial institutions via a secure and privacy-protected platform.

- opens up communication and collaboration between fincrime investigation teams from different institutions.

Improve your core

compliance toolset

Salv Bridge enhances the data you have – and better data equals better decisions. But if you also need help setting up or replacing your core compliance tools, here’s what we offer.

Core compliance

PEP and Sanction Screening

Learn more

Core compliance

Transaction Monitoring

Learn more

Core compliance

Customer Risk Scoring

Learn more