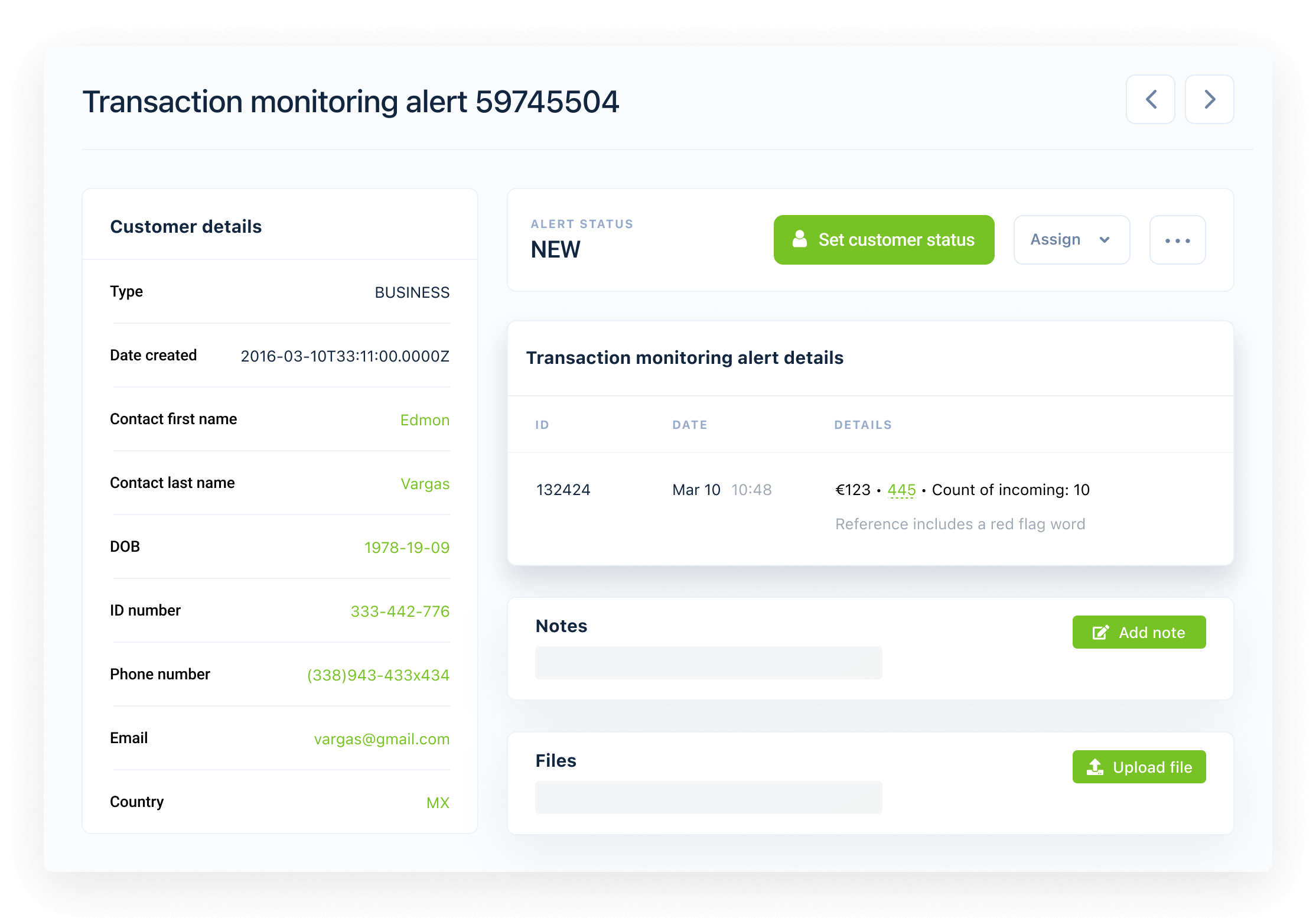

Transaction monitoring

All your monitoring needs in one place

Monitor transactions and customers, both in real-time and post-event. Identify criminal patterns with smart monitoring rules. Fight fincrime.

Meet fincrime fighters who trust Salv

Benefits and features

Real-time monitoring

Monitor your customers and transactions in real time. Run monitoring rules to suspend suspicious payments. By gathering more info, you can stop criminals right in their tracks.

Post-event monitoring

Post-event transaction data gives you insight to detect and analyse changes in customer behaviour. Identify criminal patterns and reduce risks to your business with no friction to your customer.

Built-in rule configuration tools

Add as many data fields as you want. Create and test new monitoring rules with zero engineering effort. We have 100+ monitoring rules in our library – adjust them or create your own.

Monitor counterparties with Salv

Why monitor counterparties?

1

Faster case management

Salv’s counterparty monitoring significantly speeds up the case management: all info is in one place and interlinked. Logical, frictionless user interface makes it easy for agents to dig into cases.

2

Detect changes in behaviour

Make monitoring rules which generate alerts for detecting changes in counterparty’s payment behaviour, so you can make informed decisions about your cases.

Counterparties are unique accounts your customer interacts with, the other side of the transaction. For every buyer, there is a seller.

Salv’s counterparty monitoring is engineered for payment service providers (PSPs), money service businesses (MSBs) and other financial institutions.

The counterparty functionality automatically generates a profile to the account number which either sends or receives money from your client. All the info is in one place – account number, name, email, ID code, registry code, etc. Both persons and entities can be a counterparty.

You can create and test new counterparty monitoring rules at any time with zero engineering effort.

Effortless API integration

Remove complexity

No need to spend hours on documentation, you can start the integration process within minutes.

Get dedicated support

At no additional cost, you get a personal integration manager, compliance consultant, data scientist and a product engineer.

Integrate with a single API call

No multi-step workflows. We built a simple and straightforward process to address all your needs.

The transparent UI makes Salv’s transaction monitoring convenient and easy to use. It has a clear structure that allows us to add and modify rules using our own criteria.

Q&A

Counterparty Monitoring is a radically new feature in the AML space and Salv is one of the very few providers who offers this – as part of our platform. Counterparty Monitoring gives you the full visibility of all counterparties, including those who are not immediately flagged as suspicious. With an added range of vision, not-yet-detected suspicious counterparties can be discovered and investigated.

With counterparty monitoring, you are able to examine all payments from both sides, discover all alerts raised by a particular account, identify potentially fraudulent activities, and create new rules to catch fraudsters. A clear understanding of the nature and activities of both the sender and recipient allows you to add additional layers of protection and shield your business from any fraudulent business taking root in your systems.

Learn more about how Counterparty Monitoring can help you here.

Salv’s solutions helps a wide range of financial companies to meet their AML/CFT requirements and better tackle financial crime. Our customers include fintech startups and established banks, as well as money services businesses (MSBs), payment service providers (PSPs), virtual asset service providers (VASPs), digital banks, including neobanks and challenger banks, e-commerce companies, buy now, pay later (BNPL) solutions and many more.

We help crypto companies, but only those that have a fiat element included in their business model as our solutions are not built for crypto-to-crypto transaction monitoring.

We currently help customers in more than twelve different countries in Europe and beyond.

Salv’s platform is built in a way that gives you the flexibility to choose and start out with only the products and features you need, and add on more capabilities once your business scales and your needs grow. You can of course also start out with the full solution and integrate all our platform’s features at once.

Also if you already have a working inhouse solution or you cover some of your compliance needs with a different provider, you can easily integrate our platform as an additional defence against financial crime.

The exact integration time depends on many factors, but we can point out three main influences. Firstly, it depends whether you are integrating the whole platform or only some of the products. The full platform integration obviously takes longer than integrating only Sanctions Screening or Risk Scoring.

Secondly, it depends on the quality of your data, how much preparation it needs, and whether you have your own inhouse data scientists. The same goes for the availability of your inhouse engineering power.

And thirdly, it depends on how much help you need from our side to figure out the best compliance rules for your business. We don’t like to overpromise: an integration process takes, on average, between 8-12 weeks, depending on the aforementioned aspects. However, depending on complexity and willingness, it may be completed in as few as 16 days.

When you start working with us you’ll have the full support of our integration team to get Transaction Monitoring up and running. During the integration phase there will be a dedicated Integration Manager who will make sure the integration runs smoothly and according to plan. In addition, the team includes a dedicated Engineer to help with all needed technical aspects, and a Data Scientist to help with data mapping and rule implementation. After a successful go-live a dedicated Client Manager will take over to support you further and make sure everything proceeds smoothly and your needs are covered in full.

We take our platform’s security very seriously. We have successfully completed SOC2 Type 1 audit and SOC2 Type 2 audit. Our platform is also fully GDPR compliant. All data in transport is protected by TLS encryption. Data at rest is encrypted and protected with all the latest security methods. And our developers follow OWASP guidelines.

Salv’s further solutions

Every Salv solution has the capability to integrate with your existing compliance system. Take what you need, leave the rest.

Data enrichment

Information sharing: Salv Bridge

Learn more

Core compliance

PEP and Sanction Screening

Learn more

Core compliance

Customer Risk Scoring

Learn more