Discover how LHV reduced manual work and tripled true positive rate with customisable monitoring rules

Read the case studyIt’s the end of a long day at the office and you are tired. You want to close your laptop and go home, but deep down inside, you know that unless you investigate this strangely familiar account number it will haunt your dreams forever. You do a lot of clicking around, see who else has transacted with the same counterparty, scroll through numerous pages of transactions until your eyes ache and you beg for mercy.

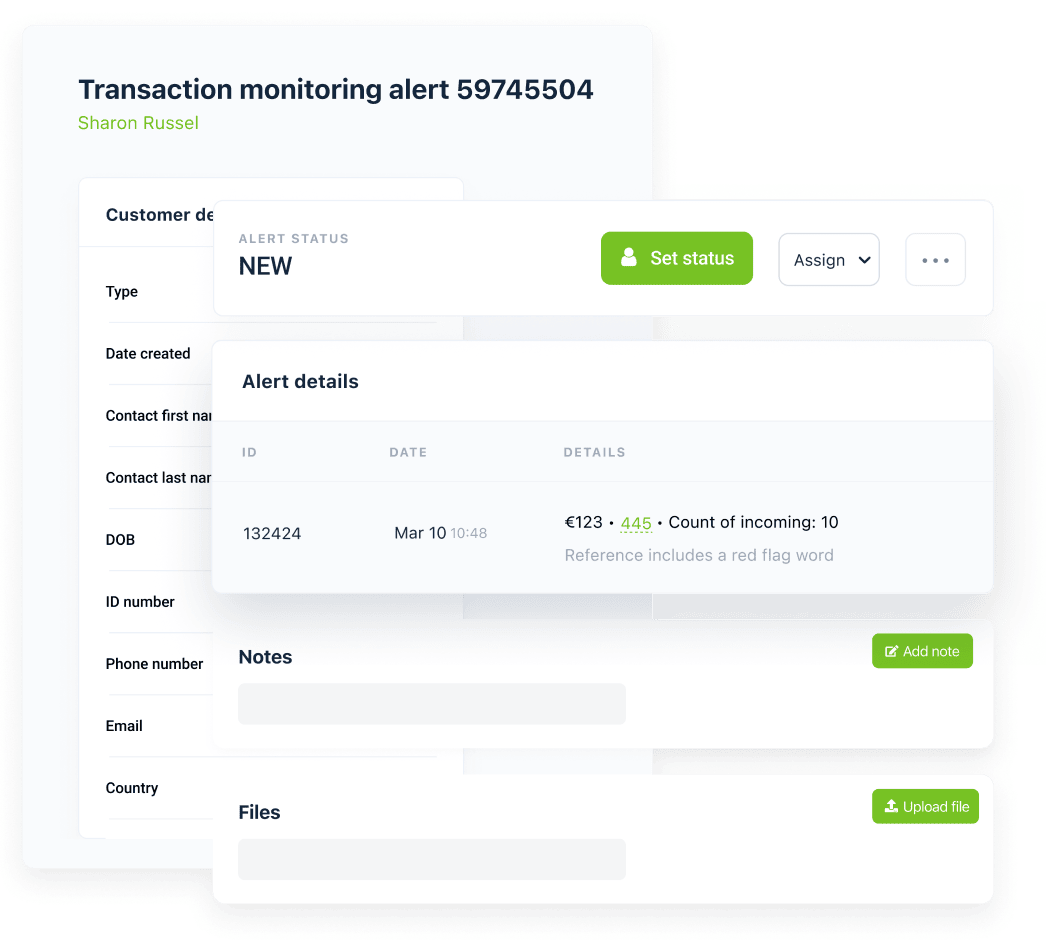

Hours later, you can stitch the pieces together, but at what cost? You may think, wouldn’t it be easier to automatically detect suspicious patterns of counterparty behaviour and access everything in one place? I bet it would. Imagine this: you click on a monitoring alert regarding a counterparty and see all historical alerts triggered by their transactions. Even more, you can see all transactions sent to and from this counterparty, figure out their relationships and connections, and assess the related risks.

With this alone, you could drastically reduce your investigation time, and make the AML industry a better place. If only… if only it were possible.

The truth is, such functionality already exists. Without further ado, let me introduce Salv’s counterparty monitoring. We built it as part of Salv’s AML Platform, and it’s helping our customers right now as I write this very sentence.

What is a counterparty?

Whenever a transaction takes place, we are dealing with counterparties. In general terms, counterparty is an opposite party in a transaction, which can include both individuals and businesses. Every transaction must have a counterparty, otherwise, it cannot be processed. Normally, organisations don’t have access to counterparty data. Salv gathers counterparty data and insights equipping you to streamline investigations and better fight money laundering and financial crime.

What is counterparty monitoring?

It’s a radically new feature that gives Salv’s clients visibility of all counterparties, including those who are not immediately flagged as suspicious. With this added range of vision, not-yet-detected suspicious counterparties can be discovered and investigated. Once counterparty monitoring has been configured for your organisation, Salv connects incoming transactions with the appropriate counterparties.

Counterparty monitoring is what helps you look behind that account number, make your way through the wardrobe filled with fur coats and enter the true crime fighter’s Narnia.

To beat financial crime, you must be faster and smarter than criminals, and adopt new technology.

Who participates in counterparty monitoring?

- A counterparty is a sender or receiver of a transaction that connects them to the service provider’s customer. The counterparty doesn’t have to be a customer of the same service provider.

- A service provider can be either a traditional bank or a FinTech company.

- Their customers include individuals and business entities.

One-to-many or many-to-one?

In the AML/CFT context, one-to-many and many-to-one are common money laundering typologies that indicate layering.

Customers make and receive transactions between numerous counterparties. When investigators exclusively focus on their own customers, they will only detect one-to-many cases. Counterparty monitoring allows to see the recipient’s other senders as well, therefore covering many-to-one cases. It makes anti-money laundering (AML) investigations and alert management much clearer and simpler to understand.

How does counterparty monitoring work?

The technology behind counterparty monitoring relies on the same monitoring features that are already part of Salv’s AML Platform. For the functionality to work, we need to collect the attributes that identify a counterparty, such as a bank account number, wallet ID (virtual card number), phone number, or email address. Additionally, you can assign personal attributes to counterparties and make it easier to search and investigate individual persons and alerts.

Counterparty monitoring can be easily configured and modified at any time using SQL-based scenarios. All known counterparties are grouped by the Counterparty identifier, which allows us to store their alerts in one place. Analysing large quantities of data would be unmanageable without help, but we have got another trick up our sleeve: aggregations. Criminals, brace yourselves for a hard time – counterparty monitoring made money laundering more difficult than ever before.

With Salv’s transaction monitoring, you can track irregularities and keep a close watch on your customers and their counterparties.

What problems can be solved by counterparty monitoring?

Counterparty monitoring opens the curtain to reveal the sources and nature of the money payments. It can point investigators in the right direction, detect criminal activity, and shield financial service providers from unnecessary risks. If counterparty monitoring were a pizza, it would be pepperoni – it’s great and everyone likes it.

With counterparty monitoring, we can examine all payments from both sides, discover all alerts raised by a particular account, identify potentially fraudulent activities, and create new rules to catch fraudsters. A clear understanding of the nature and activities of both the sender and recipient allows us to add additional layers of protection and shield financial institutions and FinTech companies from unnecessary fines and devastating scandals.

Anyone can benefit from counterparty monitoring: traditional financial institutions, organisations, big and small, among them money service businesses (MSBs) and payment service providers (PSPs). If you are an early-stage FinTech startup, you can easily manage manual workload, but over time, it will become cumbersome and inconvenient. Setting up the right processes from the start will prepare your startup for the growth that’s coming, on top of improving your AML controls.

Just think about this: only 1-2% of global money laundering is caught each year. Which means there is still a lot of work to be done by the AML industry. The dirty money, dangerous money is well hidden in the mass of seemingly healthy payments. Investigating without any clear clues is like looking for a needle in the haystack. If you don’t find that needle, you may pay a harsh price: your reputation will suffer, and fewer customers will see you as trustworthy, reliable, competent.

Financial technology sector represents a huge infrastructure of different services, heavily layered with innovation, disruption, and new breakthroughs that create change.

Salv’s core AML Platform adapts to this new competitive landscape, and makes it easy to integrate with our solutions for all players.

Book a demo and learn how we combine counterparty monitoring with our customer and transaction screening, monitoring, and boost your AML defences with Salv’s products.