Your AML is covered

Fast, flexible and transparent:

Salv’s technology has compliance covered so you can scale with confidence.

Our solutions

Salv’s toolset is modular and flexible: take what you need, leave the rest.

Core compliance

Intelligence sharing

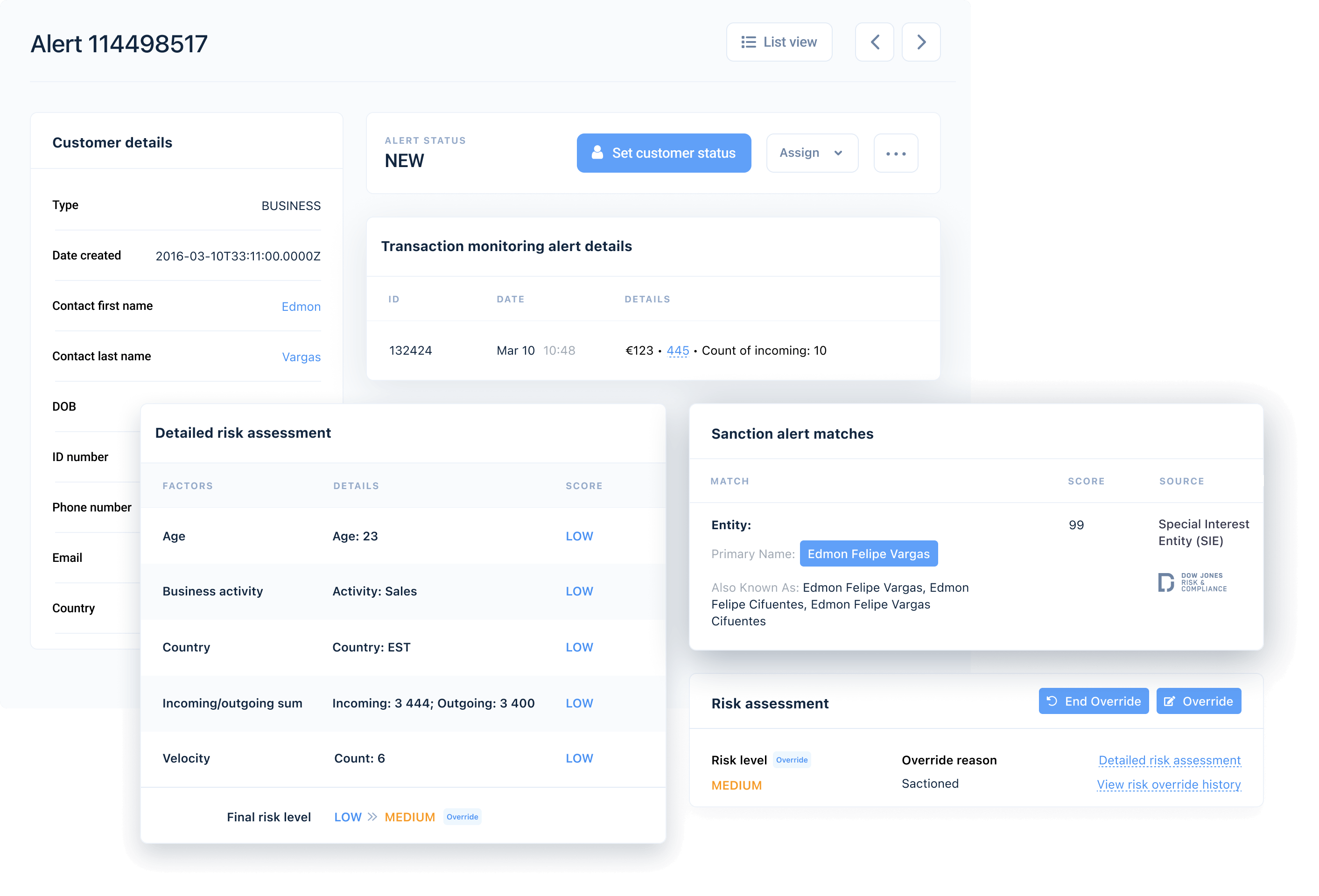

Salv Screening

Screen for sanctions, PEP/RCAs, and adverse media.

Learn more

Salv Monitoring

Detect criminal patterns in real-time and post-event.

Learn more

Salv Risk Scoring

Identify high-risk customers.

Learn more

Salv Bridge

Send and receive intelligence. Launch collaborative investigations.

Learn more

Trusted by 100+ financial institutions across Europe