PEP and Sanction screening

Customer and transaction screening

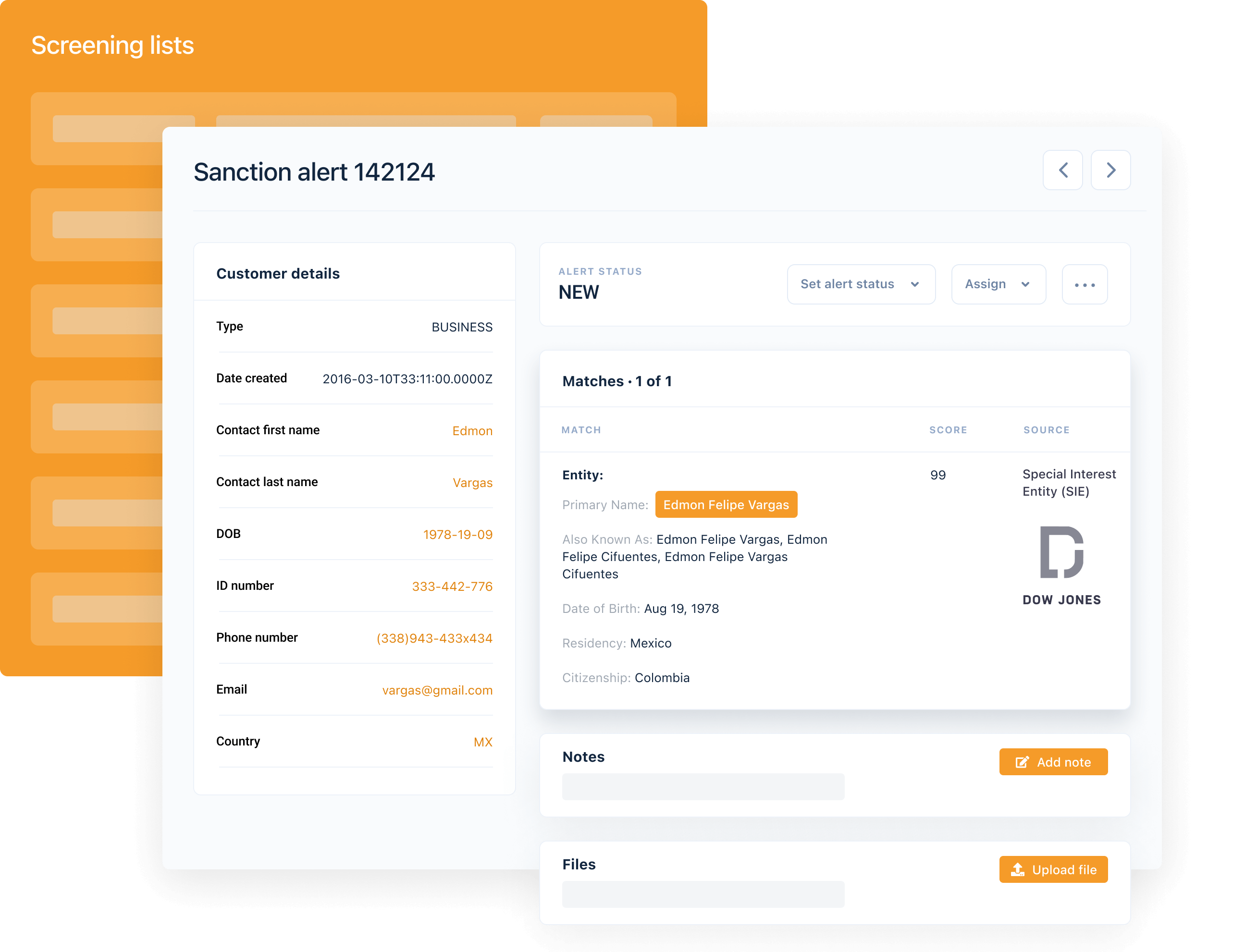

Bye-bye, backlog. With Salv Screening, you can automate hours of manual work each week to focus on the alerts that matter.

Trusted by

Introducing Salv Screening

Built for fincrime teams by fincrime teams, Salv Screening helps you improve the accuracy of your screening process and scale to meet growth.

Use Salv to automate and reduce false positives, resolve manual alerts faster, and spend more time on the investigations that matter.

Benefits and features

Real-time screening using independent data

Use intelligent matching algorithms against best-in-class data from

Salv screening covers name variations, transliterations (including multiple types of Cyrillic), and other discrepancies.

Configure based on a screening list, fuzzy match threshold, or matching type.

Auto-resolve false positives

Automation is key to focusing on the right alerts. Using Salv, one customer reduced their transactions requiring manual review from 1% to 0.14%.

Salv’s transparent rules allow you to auto-resolve false positives, reduce friction for genuine customers, and leave an audit trail of every decision

Simple customisation, low maintenance

Business users can modify your screening process (not just engineers) so you can adapt to new threats much quicker

As a modern platform, infrastructure and support are taken care of. We continually upgrade the platform with new features and improvements.

Case Study

See Why LHV Bank trusts Salv Screening

“It works really well. I can find everything I’m looking for and do more, faster than ever. Salv provides me with the accuracy and understanding that wouldn’t have been possible were my team to rely entirely on manual work.”

Get the case study to learn how LHV

- Reduced false positive alerts by 75%

- Enabled each agent to resolve over 13k alerts per month

- Transformed their fincrime team’s workload

Explore the Salv platform

We’ve built the world’s first fincrime platform with integrated intelligence sharing.

Pick and choose the tools you need to fight crime more effectively.

Data enrichment

Information sharing: Salv Bridge

Learn more

Core compliance

Transaction Monitoring

Learn more

Core compliance

Customer Risk Scoring

Learn more

Frequently asked questions

Customer and transaction screening, sometimes known as sanctions screening, is an essential compliance process that stops criminals and restricted parties from accessing financial services.

To remain compliant, financial institutions must screen transactions and new customers against predefined lists, including

- Government sanctions

- Politically Exposed Persons (PEP) and their Relatives and Close Associates (RCA)

- Adverse media

This helps detect, stop and report suspicious activities while meeting compliance obligations.

Sanctions screening is known for creating a high volume of false positive alerts, which, in turn, means an extra workload for your AML team. It’s unrealistic to bring your false positives to zero, but based on our customer’s data and experience we can reduce 90% of your false positive alerts. This is possible with the help of our sophisticated clearance rules that help you automatically reduce most of the alerts that you otherwise would need to check manually.

You can choose from 50+ clearance rules in our library or create the rules that best fit your organisation’s needs. Our clearance rules have been successfully tested by our customers.

If you are new to sanctions and want to learn more how to ensure the effectiveness of sanctions, then read more here.

Salv’s solutions helps a wide range of financial companies to meet their AML/CFT requirements and better tackle financial crime. Our customers include fintech startups and established banks, as well as money services businesses (MSBs), payment service providers (PSPs), virtual asset service providers (VASPs), digital banks, including neobanks and challenger banks, e-commerce companies, buy now, pay later (BNPL) solutions and many more.

We help crypto companies, but only those that have a fiat element included in their business model as our solutions are not built for crypto-to-crypto transaction monitoring.

We currently help customers in more than twelve different countries in Europe and beyond.

Salv’s platform is built in a way that gives you the flexibility to choose and start out with only the products and features you need, and add on more capabilities once your business scales and your needs grow. You can of course also start out with the full solution and integrate all our platform’s features at once.

Also if you already have a working inhouse solution or you cover some of your compliance needs with a different provider, you can easily integrate our platform as an additional defence against financial crime.

The exact integration time depends on many factors, but we can point out three main influences. Firstly, it depends whether you are integrating the whole platform or only some of the products. The full platform integration obviously takes longer than integrating only Sanctions Screening or Risk Scoring.

Secondly, it depends on the quality of your data, how much preparation it needs, and whether you have your own inhouse data scientists. The same goes for the availability of your inhouse engineering power.

And thirdly, it depends on how much help you need from our side to figure out the best compliance rules for your business. We don’t like to overpromise: an integration process takes, on average, between 8-12 weeks, depending on the aforementioned aspects. However, depending on complexity and willingness, it may be completed in as few as 16 days.

When you start working with us you’ll have the full support of our integration team to get Screening up and running. During the integration phase there will be a dedicated Integration Manager who will make sure the integration runs smoothly and according to plan. In addition, the team includes a dedicated Engineer to help with all needed technical aspects, and a Data Scientist to help with data mapping and rule implementation. After a successful go-live a dedicated Client Manager will take over to support you further and make sure everything proceeds smoothly and your needs are covered in full.

We take our platform’s security very seriously. We have successfully completed SOC2 Type 1 audit and SOC2 Type 2 audit. Our platform is also fully GDPR compliant. All data in transport is protected by TLS encryption. Data at rest is encrypted and protected with all the latest security methods. And our developers follow OWASP guidelines.

Ready to screen smarter?

Fill out the form to book your personalised demo.

Let’s make the world a safer place.