Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn moreComplyAdvantage, an anti-money laundering (AML) and know-your-customer (KYC) software provider, offers a wide range of compliance solutions, with a focus on AI-driven fraud and AML risk detection. The company caught our eye because it integrates perpetual KYC (pKYC) with real-time transaction monitoring, offering a comprehensive approach to combating financial crime and maintaining regulatory compliance.

ComplyAdvantage stands out in their field, but there are some noteworthy alternatives, and we are going to cover them in this blog. But first, let’s take a closer look at ComplyAdvantage and what they do so well.

Disclaimer: Data and information presented in this article was gathered from online sources during November 2023. If you want to learn more about how this article was written, or about the providers and services we discuss, get in touch.

What does ComplyAdvantage offer?

Founded in 2014, ComplyAdvantage provides financial institutions with software designed to identify and manage AML and fraud-related risks, with the help of artificial intelligence (AI) and machine learning (ML) technology.

Their wide-ranging compliance solutions cover screening-powered customer onboarding, which includes both screening and monitoring customers against sanctions, watchlists, and PEPs. ComplyAdvantage uses AI/ML algorithms to monitor transactions and events in real time and detect patterns of suspicious behaviour and fraud.

As of now, ComplyAdvantage is used by over 1,000 financial institutions and banks globally, with notable customers such as Allianz, OakNorth Bank, and Santander, among others.

How does ComplyAdvantage connect perpetual KYC with real-time transaction monitoring to create a robust compliance framework for its customers? Let’s examine this in detail.

Perpetual KYC

ComplyAdvantage is a well-suited tool for financial institutions looking to adopt and utilise perpetual KYC, a process tailored to meet the increasingly complex requirements of AML compliance and regulations.

Perpetual KYC differs from traditional KYC checks in the way that it uses a continuous process of updating and verifying customer data in real time. This enables firms to detect financial crime early on, therefore increasing efficiency and reducing silos and overheads as well as reducing the risk of incurring fines. Another important possible benefit is the resulting improvement of customer experience, which can enhance retention as well as brand reputation.

As mentioned earlier, ComplyAdvantage offers real-time sanctions and watchlist screening using global lists from OFAC, EU, UN and other governmental, law enforcement, and regulatory databases, also covering politically exposed person’s (PEPs) and adverse media. Their real-time risk screening collects data for AML and CFT in minutes through the use of AI.

Real-time transaction monitoring

Real-time transaction monitoring allows firms to check transactions as they occur, ensuring that any suspicious transactions are detected and investigated before being processed.

ComplyAdvantage utilises AI to monitor all transactions in a single easy-to-understand user interface that does not require coding. Users can customise their transaction monitoring based on a predefined set of scenarios, while also feeding their own data into the system, thus effectively reducing false positives.

While ComplyAdvantage offers extensive benefits, it’s good to be aware of potential limitations, such as over-reliance on AI. It’s important to carefully weigh possible drawbacks and benefits, as well as compare different providers, before making a final decision.

Why look for a ComplyAdvantage alternative?

ComplyAdvantage employs the latest technology for perpetual KYC and real-time AML risk and fraud detection. However, it’s important to note that their solution, while comprehensive, may not always cater to unique business needs due to its broad approach.

For those seeking tailored options, specialised providers are available that can offer customised solutions based on specific business requirements and needs.

If collaboration across institutions is part of your roadmap, it’s worth understanding the legal requirements. Our guidance on intelligence sharing breaks down what’s allowed — and how to do it right.

Next, we will explore potential alternatives to ComplyAdvantage – providers who specialise in perpetual KYC or real-time transaction monitoring.

List of ComplyAdvantage alternatives

- Salv – transaction monitoring, customer screening, and cross-institution intelligence sharing

- Fenergo – real-time transaction monitoring, perpetual KYC

- Moody’s Analytics – automated KYC/KYB, perpetual KYC

- smartKYC – perpetual KYC

- Flagright – real-time & risk-based transaction monitoring

- AMLYZE – real-time transaction monitoring

- HAWK:AI – AI-powered transaction monitoring

7 ComplyAdvantage alternatives

Salv

Great for: transaction monitoring, customer screening, and real-time intelligence sharing across institutions

Salv is a financial crime-fighting platform built by former Wise and Skype engineers. Salv helps firms detect risks, share intelligence, and investigate cases more effectively.

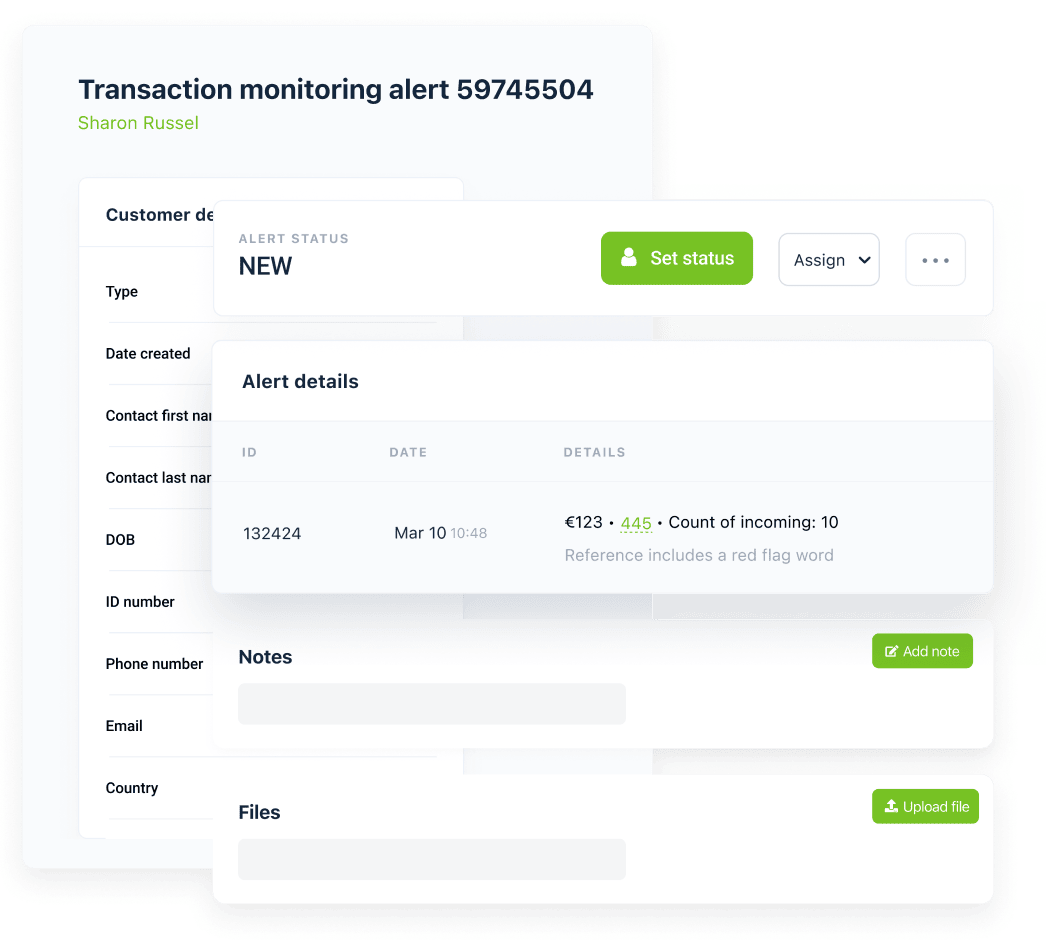

With Transaction Monitoring, financial institutions can configure and test monitoring rules without code, add unlimited data fields, and build custom logic to reduce false positives. Everything can be tested safely in a sandbox environment before going live.

With Screening, firms can screen customers, transactions, and third parties against sanctions, watchlists, PEPs, and adverse media — with flexible configuration to fit each organisation’s risk appetite.

And with Salv Bridge, institutions can collaborate in real time on fraud, money laundering, and sanctions cases. Bridge enables fast, compliant information sharing across institutions, helping teams recover funds and disrupt mule networks.

To date, Bridge has facilitated more than 56,000 compliant intelligence exchanges across 14 jurisdictions in the EU and the UK, giving financial institutions the confidence that collaboration can be both effective and lawful. Institutions using Bridge report recovery rates increasing by up to 80%.

If you’re wondering how this works legally, read Salv’s intelligence sharing guidance — it outlines exactly when and how institutions can collaborate lawfully across borders.

Together, Salv’s tools cover the full spectrum: from risk detection and screening, to collaborative intelligence sharing that goes beyond the walls of a single institution.

How to choose the right ComplyAdvantage alternative

It can be tempting to rush into a decision, but when it comes to something as complex as compliance, there is no one-size-fits-all solution. Choosing the right AML/KYC service provider will always heavily depend on the particular needs of a business and whether the chosen software can meet them.

ComplyAdvantage alternatives FAQ

1. Which of the ComplyAdvantage alternatives is easiest to implement?

There are many factors to consider, including regulatory compliance requirements, system compatibility, vendor support and collaboration, company size and structure, training and user adoption.

To establish a realistic timeframe for implementation, the best solution is to contact the providers for further information. Ultimately, the timeframe and complexity of integration will depend on specific profile of your business and the solution you have chosen.

2. How user-friendly are the ComplyAdvantage alternatives for non-technical users?

Many of the providers mentioned in this post offer no-code platforms.

Salv, for example, does not require any technical skills at all for users to be able to create and test monitoring rules all on their own.

Some other no code platforms to consider are: HAWK:AI, AMLYZE and Flagright.

In summary, ComplyAdvantage presents compelling solutions tailored for financial institutions who seek a streamlined KYC approach while aiming to minimise fraud through advanced AI-driven fraud detection.

Nonetheless, it’s worth noting that alternative solutions may offer greater flexibility and customisation. The final choice should of course align with the specific requirements and nuances of the business.