Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn moreIn March 2022, Salv hosted an online webinar, “FinCrime Experts Meetup: Time to stop working in silos”. Based on real examples, practical advice and insights, the webinar attracted hundreds of crime-fighters in the UK, the Nordics and the Baltics. Nick Maxwell, the head of the Future of Financial Intelligence Sharing (FFIS) Research Programme, opened the event with a presentation on public-private and private-private information sharing and its role in detecting, preventing, and disrupting financial crime.

What is the Future of Financial Intelligence Sharing (FFIS) Research Programme?

The FFIS programme is a research partnership between the Royal United Services Institute (RUSI) Centre for Financial Crime and Security Studies and NJM Advisory. With a history of almost 200 years, RUSI is the world’s oldest defence and security think tank. The Centre for Financial Crime and Security Studies (CFCS) is still relatively young. Founded in 2014, it contributes publicly available research information to stimulate discussion and innovation in the field of crime-fighting.

The FFIs programme focuses on the issues and processes related to public-private and private-private information sharing and its capacity to detect and disrupt financial crime. Before we move any further, let’s try to understand the private sector’s everyday struggles.

What are some common challenges faced by private sector entities?

When it comes to detecting and preventing financial crime, the majority of private sector entities face the same challenges.

- Lower efficacy. Criminals operate within cross-border networks that are hard to detect and dismantle. This is why analytical teams working in silos will always have a lower efficacy in detecting financial crime patterns compared to teams working in networks.

- Lower visibility of threats. Both public and private sector entities work largely with their own fragmented data, which results in limited visibility of threats across financial institutions. Financial institutions face increasing risks because they operate with incomplete data and, in many cases, can’t see the full picture.

- Excessive reporting. From a regulatory perspective, it’s better to over-report rather than under-report. This trend drives a lot of reporting that is neither helpful nor useful to law enforcement.

One way to address the existing challenges is to facilitate public-private and private-private information sharing.

What is public-private information sharing?

Public-private information sharing enables tactical information exchange between public agencies and private sector entities. As a result, private sector entities have a better understanding of their own data, and can submit more relevant and timely suspicious activity reports (SARs) allowing the criminal justice system to convict criminals in a more efficient way. Public-private information sharing partnerships are instrumental in supporting dialogue on topologies and behavioural insights into financial crime threats.

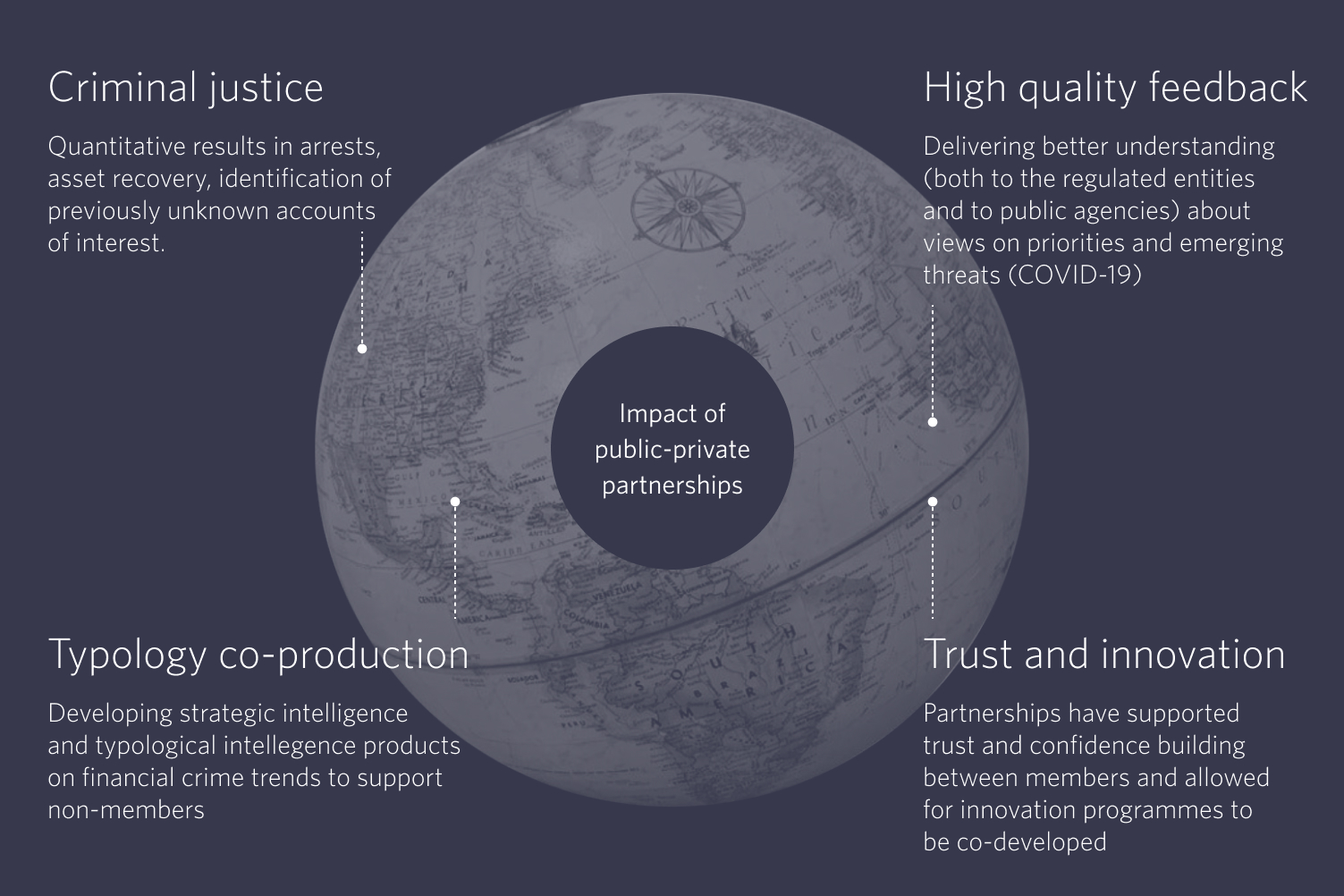

What is the impact of public-private partnerships?

- Trust and innovation. Public-private partnerships support trust and confidence building between members, and inspire co-development of innovation programmes.

- Typology co-production. Non-members benefit from strategic intelligence and typological intelligence products on financial crime developed through public-private partnerships.

- High quality feedback. Public-private partnerships contribute to better understanding (across regulated entities and public agencies) of emerging financial crime threats.

- Criminal justice. Public-private partnerships lead to considerable improvements in investigation, reporting, and prosecuting financial criminals.

Public-private information sharing is still under development, nevertheless, it has already established itself in many countries across the world. Meanwhile, private-private information sharing is gaining momentum as the next frontier of collaboration to address financial crime threats.

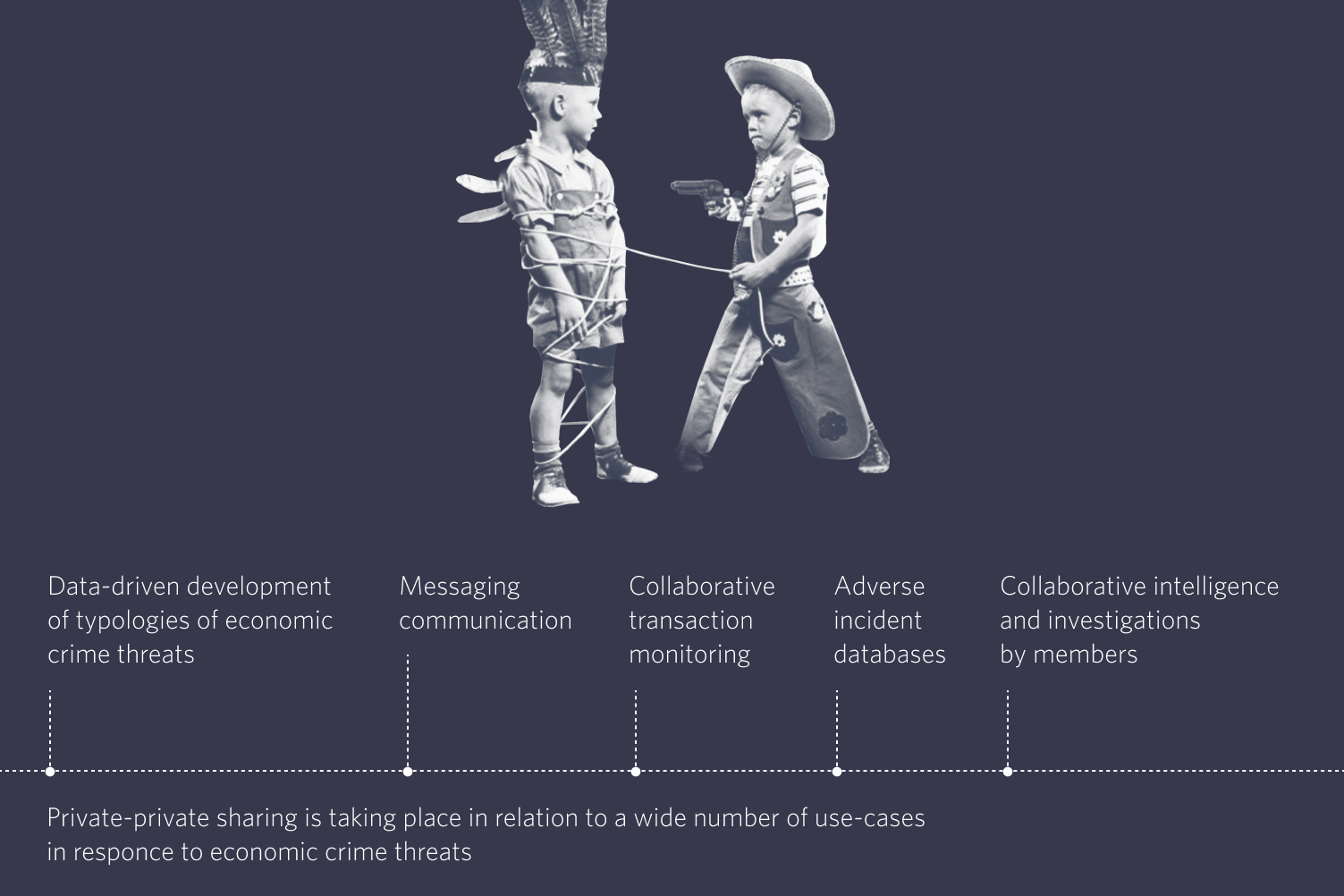

What is private-private information sharing?

Private-private financial information sharing offers capabilities that private sector entities need in order to respond to emerging financial crime threats. This type of information sharing provides the private sector with a much bigger, smoother, clearer picture, and contributes to the development of typologies of financial crime threats.

Private-private information sharing supports messaging communication in many jurisdictions, and can be used to enhance an understanding of financial crime threats. It can be used to discount a concern or explain away a concern that doesn’t need to be filed as suspicious. That way, the threat identified by one financial institution can then be shared with other partnership members. Private-private information sharing encourages collaborative intelligence and investigations by members, resulting in incredible transparency, efficiency, and efficacy.

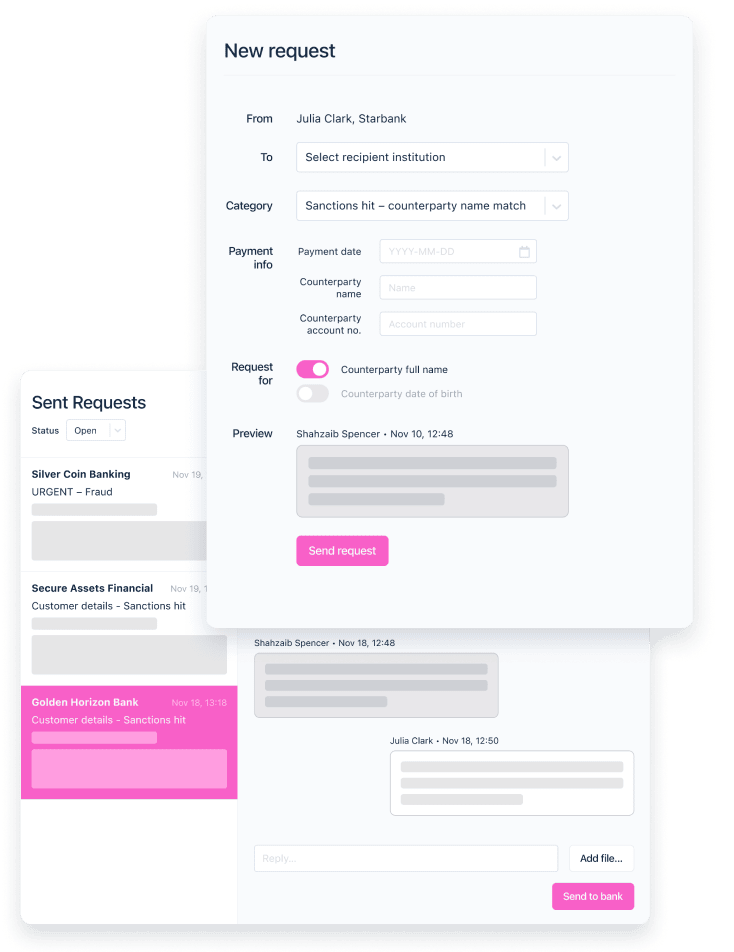

AML Bridge is one example of the benefits offered by private-private information sharing. Read the key findings from the Salv Bridge pilot or access the latest Salv Bridge white paper here.

What policy facilitates private-private information sharing?

There is considerable ongoing policy and practitioner interest in private-private information sharing. Emerging policy-development projects focus on supporting more effective collaboration for the detection of money laundering risks and exploring or expanding private-private financial information sharing. The following reports and strategic action plans enable seamless private-private information sharing across jurisdictions and across continents.

- FATF ‘Stocktake on Data Pooling, Collaborative Analytics and Data Protection (2021).

- The Netherlands 2019 “Joint Action Plan” on the prevention of money laundering (transaction monitoring and post-suspicion private-private sharing).

- 2019-2022 UK Economic Crime Plan (pre-suspicion and post-suspicion private-private sharing)

- The US 2021 Anti-Money Laundering Act and prescribed growth of FinCEN Innovation programmes.

- Singapore public consultation on a new ‘COSMIC’ platform and accompanying legislation – “Collaborative Sharing of ML/TF Information & Cases”.

The global geopolitical, social and economic landscapes are rapidly transforming, preparing us for new challenges. Along with that, we see public-private and private-private information sharing gain increasing global recognition. It fosters innovation and growth, and contributes to better understanding of financial crime threats.

The advantages offered by public-private and private-private information sharing are hard to beat. If you want to learn more about secure and compliant information sharing in the finance industry, book a demo.

- What is the Future of Financial Intelligence Sharing (FFIS) Research Programme?

- What are some common challenges faced by private sector entities?

- What is public-private information sharing?

- What is the impact of public-private partnerships?

- What is private-private information sharing?

- What policy facilitates private-private information sharing?