The proven way to share AML intelligence

LEARN MOREFinancial crime is on the rise across Europe. And in Lithuania, it’s no different. More than 98,500 suspicious money transactions were reported in Lithuania last year, according to the country’s Financial Crime Investigation Service. One Lithuanian financial institution alone was responsible for laundering more than €2 billion for criminals, says Europol.

Against that backdrop, the Lithuanian government is stepping up its efforts to crack down on financial crime. Amendments to its anti-money laundering and counter-terrorist financing rules were introduced on August 1st 2024 to clarify how Lithuanian financial institutions can exchange intelligence with each other to prevent fraud and other financial crimes.

“They can exchange information about entities where a business relationship was terminated or not opened due to concerns around fraud or sanctions,” says Justas Valentinavičius, Lithuanian market lead at Salv. “That can include information such as how many fraud investigations are being done or the amount of money refunded.”

While some institutions have already been sharing a limited scope of information for some time, the new rules define the technical specifications banks will be expected to adhere to when using a data exchange platform.

What do financial institutions need to know?

-

Financial institutions can share information about suspicious customer activity, though they can’t say whether they have submitted a Suspicious Activity Report (SAR) to Lithuania’s Financial Crimes Investigation Service (FCIS). They can use information gathered while exchanging with other FIs as part of their reports.

-

Financial institutions can only use data exchange platforms to share information with other financial institutions registered in Lithuania or those providing services in Lithuania using EU passporting rights. The scope is expected to expand to the EU once the AMLR directive comes into play in 2025.

-

Transaction investigations between counterparty banks (not limited to Lithuania) are allowed based on legitimate interest.

-

Financial institutions must inform the Financial Crimes Investigation Service if they start sharing information through a data exchange platform.

- Financial institutions can share data related to

- suspicious transactions

- the client’s legal entity

- persons involved in the ownership and control structure

- the termination/non-initiation of business relations or transactions

- the purpose of the request.

- Financial institutions cannot share data with crypto or virtual asset service providers (CASPs/ VASPs) as they do not fall under Lithuania’s legal description of a financial institution. This will change on 30/12/2024, when the definition gets extended to include CASPs/ VASPs.

Adopting these technical specifications is effectively an interim period, as it comes ahead of planned new anti-money laundering regulations in the European Union, which includes rules around pan-European information sharing (Article 75) to support financial crime-fighting across the 27-nation bloc.

However, there’s reluctance in Lithuania to exchange financial information industry-wide. The country’s AML Centre of Excellence includes banks within its planned data-sharing programme but currently limits participation for fintechs.

“Fintechs are willing to share information with banks, but I’m not sure if banks will be willing to share information with fintechs,” explains Justas.

“But this is not about competition. The aim is to fight these crimes, find the bad actors in the market and terminate those relationships,” says Justas.

In any case, even if banks only exchange information among themselves, they need to decide how they will make this information available to others—should they build an in-house data exchange, or should they partner with a third-party provider?

The first option may seem like a big undertaking. Building something in-house is not only costly, but it’s also time-consuming and can be frequently delayed by changing internal priorities.

“It’s much more effective to use a third party who can provide an intelligence exchange platform and maintain it for you,” says Justas.

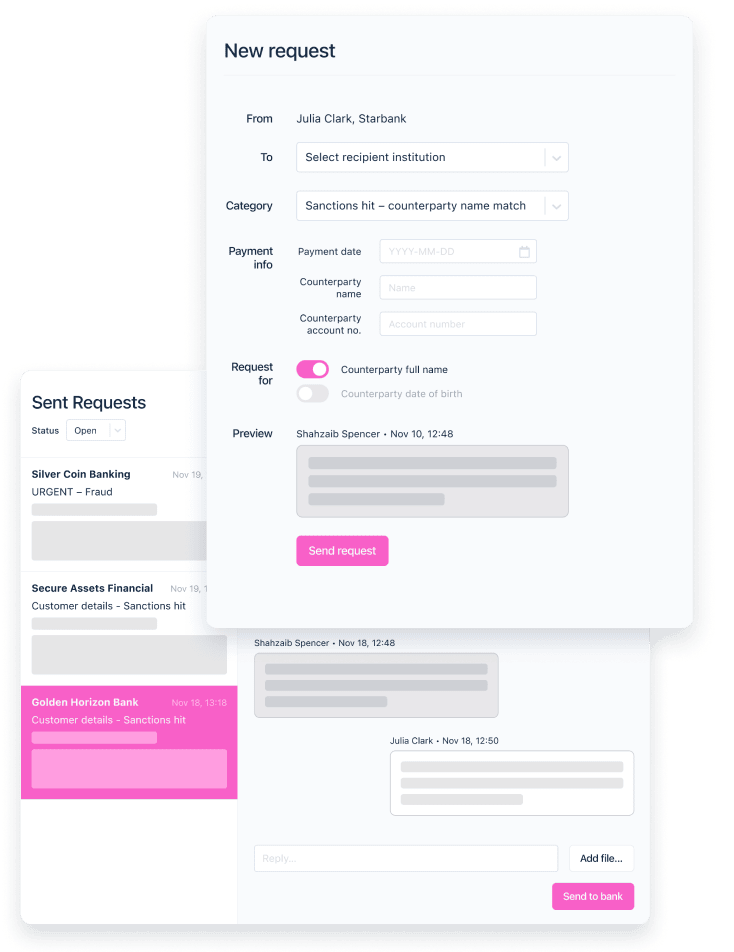

Using an established financial crime platform like Salv, which helps more than 100 banks and fintechs across Europe detect money laundering, share intelligence, and stop fraud, Lithuanian financial institutions can be sure they are investing in a proven solution.

“We know what works and what doesn’t. We can implement it quickly so banks and fintechs can start exchanging information quickly,” Justas says.

It’s safe and secure, with all messages encrypted so only the relevant parties can exchange information. Plus, pre-defined templates make it fast and easy to create and respond to requests for information (RFIs).

“In the Netherlands, there was a solution that major banks were using. They were forced to close because it was not complying with GDPR requirements and new AML legislation,” says Justas. “Our solution complies with these regulations, providing strong data security and protection.”

Organisations can also decide who they share information with through friends lists, which can easily be toggled on and off, allowing them to manage their own data-sharing network.

For Lithuanian financial institutions looking to strengthen their crime-fighting approach, an independent solution like Salv can help to confirm suspicious activity faster, reducing risk while complying with all local and EU data regulations.

To speak with Justas and learn more about intelligence sharing with Salv, hit the button below.