Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn more- Regtech Salv, specialising in combating financial crime, closes €4m seed round extension led by ffVC

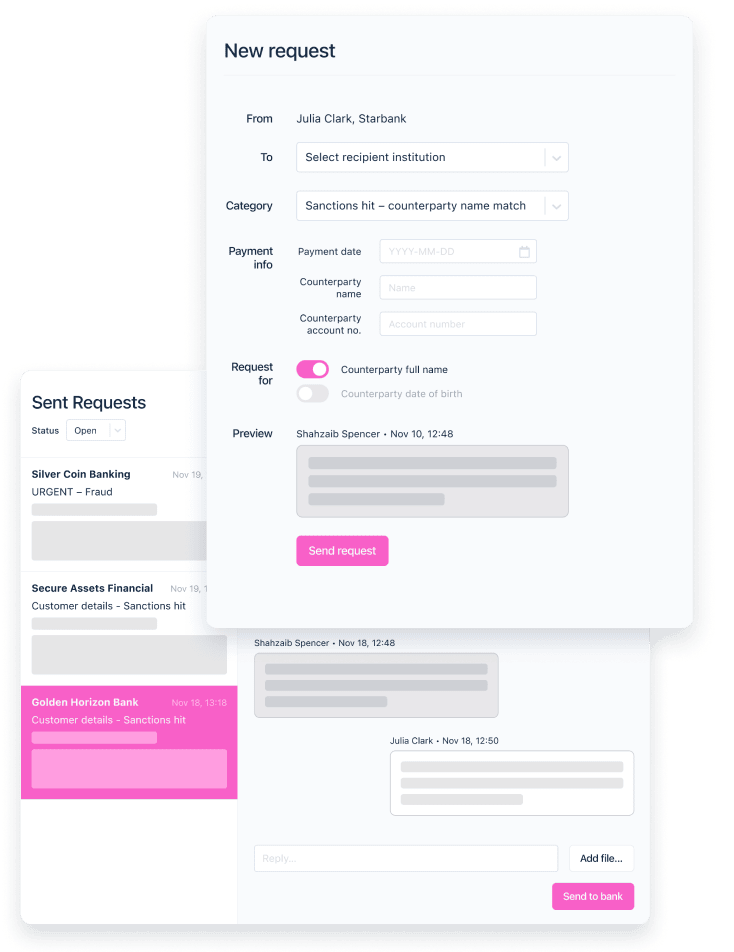

- Salv Bridge is the world’s first real-time collaborative crime-fighting platform that uses the collective power of its network to minimise non-compliance and financial crime

- Salv platform is proven effective against fraud, sanctions screening and money laundering

- The financial companies within Salv’s collaborative crime fighting network have already prevented 6-7M€ from reaching criminal-controlled accounts by resolving fraud cases significantly faster, in minutes instead of days

- According to the UK Finance fraud report, in H1 2022, APP fraud losses amounted to 250M pounds, and only around 6% of it was successfully recalled, leaving criminals with a 94% success rate

Tallinn, Estonia and London, UK 26 January 2023: Salv, the regtech startup founded by former Wise and Skype employees, closes a €4m seed round extension led by ffVC, with German G+D Ventures and existing investors also participating. The funds will allow Salv to further develop its modular regtech technology and support geographical expansion to new territories, including Poland.

Salv’s collaborative crime-fighting technology Salv’s offering entails all the necessary AML functionality for financial services companies, such as automatically identifying and prioritising suspicious activity and processing vast amounts of data in real time. The company’s toolset also includes its proprietary collaborative crime-fighting platform - Salv Bridge, which uses the collective power of its network to minimise non-compliance and financial crime.

The world’s first fully GDPR-compliant platform, Salv Bridge, enables collaborative investigations between financial institutions by opening a direct line of communication - allowing them to exchange and enrich data on potential threats. This helps network members solve fraud cases in minutes, not days. By utilising this collective intelligence from financial institutions within the Bridge network, Salv’s tools can adapt to evolving threats.

Taavi Tamkivi, CEO and co-founder of Salv, commented on the new market entry: “The digitalisation of the financial industry has resulted in an avalanche of financial crime, and the numbers are only projected to grow. our collaborative-crime fighting platform, Salv Bridge, is proven to be effective against money laundering, sanctions and fraud. The funds allow us to add further functionality to our modular AML toolset and expand to new markets, helping more companies greatly improve their crime-fighting measures and thereby protect their end-customers.”

Why collaboration is needed to effectively fight financial crime: Taking advantage of the explosive growth of the financial technology industry, financial crime - especially fraud - has recently seen a meteoric rise. The low-risk, high-profit nature and the low probability of prosecution due to the complexity of cross-border investigations make fraud an attractive activity for international organised crime groups, who benefit from differences in national legislation.

Criminals are successful because they have large, efficient international networks for sharing information, whilst financial institutions lack the means to securely and effectively exchange information on suspicious activity. Operating in silos, they try to solve problems individually, often losing precious time, which is crucial for a successful fraud recall.

Andres Kitter, Deputy CEO of LHV UK, said: “LHV Bank took part in the Bridge pilot and saw excellent results in a short timeframe - authorised push payment fraud cases dropped significantly across the network. In the UK, where we process payment volumes worth hundreds of millions every day, Salv’s solutions allow us real-time communication with other institutions within the network and provide us with tools to apply effective countermeasures to constantly changing patterns of financial crime.”

Mateusz Zawistowski, Managing Director of ffVC, commented on their investment: “We invested in a working solution that has already proven effective against financial crime. For us, an important element was that 21 financial institutions in Europe have already joined the collaborative crime-fighting network and collectively solved almost 7000 investigations, helping to prevent €6-7m from reaching criminals. We see a huge potential for geographical expansion and more financial institutions joining the network to improve their compliance and crime-fighting capabilities.

Salv is the world’s first real-time collaborative financial crime-fighting platform. With only 1% of financial crime being detected right now around the world, Salv’s mission is to give financial institutions tools to fight financial crime more effectively.

Founded in 2018 by Taavi Tamkivi (CEO), Jeff McClelland (COO), and Sergei Rumjantsev (CTO), Salv’s team of more than 60 employees includes experienced anti-money laundering experts and financial crime fighters from Skype and Wise.

The company has raised 7.3 million euros from investors such as ffVC, G+D Ventures, Fly Ventures, Passion Capital, Seedcamp, Superangel, United Angels VC, N26 founder Maximilian Tayenthal, former LexisNexis CEO Andrew Prozes, LHV founder Rain Lõhmus, former CIO for Estonia Taavi Kotka, and former Skype Estonia CEO Sten Tamkivi and many others.

Additional information:

Lauri Haav

Chief Growth Officer

[email protected]