Real-time transaction monitoring is our best defence against instant payments fraud.

Transaction monitoring is a very straightforward process; it means exactly what it suggests: monitoring of customers’ transactions such as withdrawals, deposits, purchases, and so on. Customer and transaction monitoring seeks to identify patterns of suspicious activity, which could indicate money laundering, analyse transactional data, and enhance the EDD controls.

Transactions can be monitored in real time, periodically, or after they have been processed. It all depends on the bigger picture, your business needs and level of risk. So, why are we suddenly focusing on real-time transaction monitoring? Because it’s our best defence against instant payments fraud.

Remember, instant payments don’t necessarily equate to instant fraud. They can also translate into the immediacy and accuracy of the compliance response. This blog will provide a practical framework for detecting and responding to fraud in real-time. You will receive pragmatic advice on enabling real-time transaction monitoring, and learn how to set it up with Salv.

Fraud in instant payments

The rise of instant payments has opened new avenues for criminals to exploit. Instant payments are convenient and efficient, allowing you to receive money in seconds. However, this leads to various new fraud scenarios, where authorised or unauthorised parties are either tricked into sending money, or they knowingly participate in fraudulent activities.

One such example is authorised push payment (APP) fraud, which involves social engineering to trick a victim into sending money to a fraudster-controlled account. In 2022, APP fraud accounted for 40% of fraud losses in the UK alone, according to a report by the Payment Systems Regulator (PSR). The losses totalled nearly 500 million GBP. Across the English Channel, the situation is similarly concerning. In its 34th annual report, the EU’s anti-fraud watchdog identified fraud-related irregularities worth €1.77 billion in 2022, with some attributed to APP fraud.

Instant payments increase pressure on the payment scheme providers in terms of processing volume and compliance. Real-time transaction monitoring rises to the challenge, offering a cost-effective and efficient way to filter fraud from instant payments.

Understanding real-time transaction monitoring

The essence of real-time transaction monitoring lies in the speed of the system’s response, which needs to be extremely fast, typically in milliseconds. With the rise of instant payments, financial institutions often have only seconds to decide whether to accept or reject a payment.

For example, in the UK, the processing time is 20 seconds, meaning the decision whether to accept or reject a payment must be made within less than 10 seconds. Reducing the compliance provider’s response to less than 2-3 seconds can significantly improve the detection of fraud in instant payments.

It’s crucial that these checks are done in milliseconds, at a point when reversing the payment is still possible, thus minimising the customer impact.

Impact of real-time transaction monitoring on fraud detection

Increase the speed of response to handle real-time processing

The main concern often revolves around the API’s speed and its ability to handle real-time processing.

Instant payments require an auto-reject feature where a control failure notification is sent to the sending bank. In contrast, the regular SEPA payments allow more time for banks to decide whether to accept or suspend a transaction. The API’s speed is critical in instant payments as well; if it’s not fast enough, financial institutions can’t process payments, leading to potential repercussions from payment schemes.

Continuous rule testing to reduce customer impact

When dealing with real-time monitoring, the impact on customers comes first. You don’t want to reject good customers or cause unnecessary delays in payments unless your monitoring rules are highly accurate.

Continuous testing of these rules is critical in preventing the suspension of legitimate customers, thereby improving customer satisfaction and minimising customer churn.

At Salv, for example, you can test monitoring rules, perform quality assessments, and adjust thresholds in the sandbox before going live. This ensures that real-time implementations are efficient and don’t inconvenience customers or lead to unintended outcomes. If certain components of your real-time monitoring are not yielding the desired results, you can switch them off or move to post-processing.

Alert management to automate the transaction process

Efficient alert management can streamline the entire transaction process. For example, when an agent marks a transaction monitoring alert as a false positive, it’s automatically released, reducing manual workload and the need to manually release transactions.

Processes like freezing or releasing funds can be automated based on investigation results, thereby improving operational workflow. This automation goes beyond just processing transactions and extends to entire account freezing, providing ways to enhance efficiency.

Real-time transaction monitoring checklist

In summary, when looking into real-time transaction monitoring to ramp up your anti-fraud defences, make sure you follow our checklist:

✔️ Check the speed of the API response

The speed of the API response directly correlates with payment processing time. This correlation allows you to reject fraudulent payments within a short processing time thus helping you to avoid penalties from the payment schemes.

✔️ Monitoring rule testing sandbox

If the provider gives access to the sandbox – test your monitoring rules. Rule testing is a powerful tool that allows you to adjust your processes quickly to the changing fraudulent patterns.

✔️ Efficient alert management

Efficient alert management leads to more automation, thereby improving efficiency of your real-time transaction monitoring.

✔️ Data visualisation

Make sure you can easily visualise data for optimal results. Dashboards play a crucial role in completing the feedback loop, enabling you to react promptly to changing fraudulent patterns. Toggling rules on and off (at least with Salv Monitoring) – it doesn’t get much easier than that!

How to set up real-time transaction monitoring

Let’s now examine how to set up a real-time transaction monitoring process in Salv Platform.

You can easily create, update, and test transaction monitoring rules with zero engineering effort. We’ve put everything you need into one page – Salv’s Analyst Toolbox – to save you time and effort searching around.

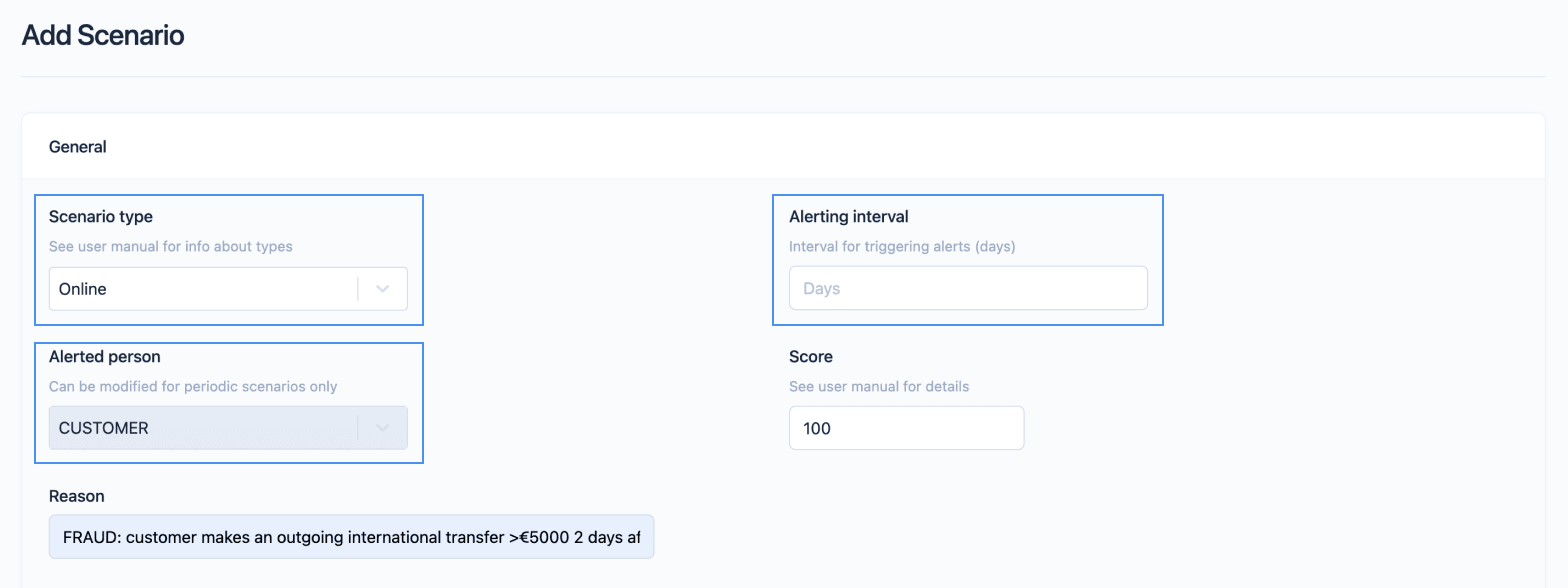

To make this example practical for real-time transaction monitoring aimed at detecting fraud, we have chosen rapid movement of funds – a common AML red flag and a money laundering risk. For the purposes of this exercise, we select ‘real-time’, add the reason as ‘customer makes an outgoing international transfer > €5000 after receiving a domestic transfer’ and establish an alerting interval of 2 days.

Setting up a rule for rapid movement of funds

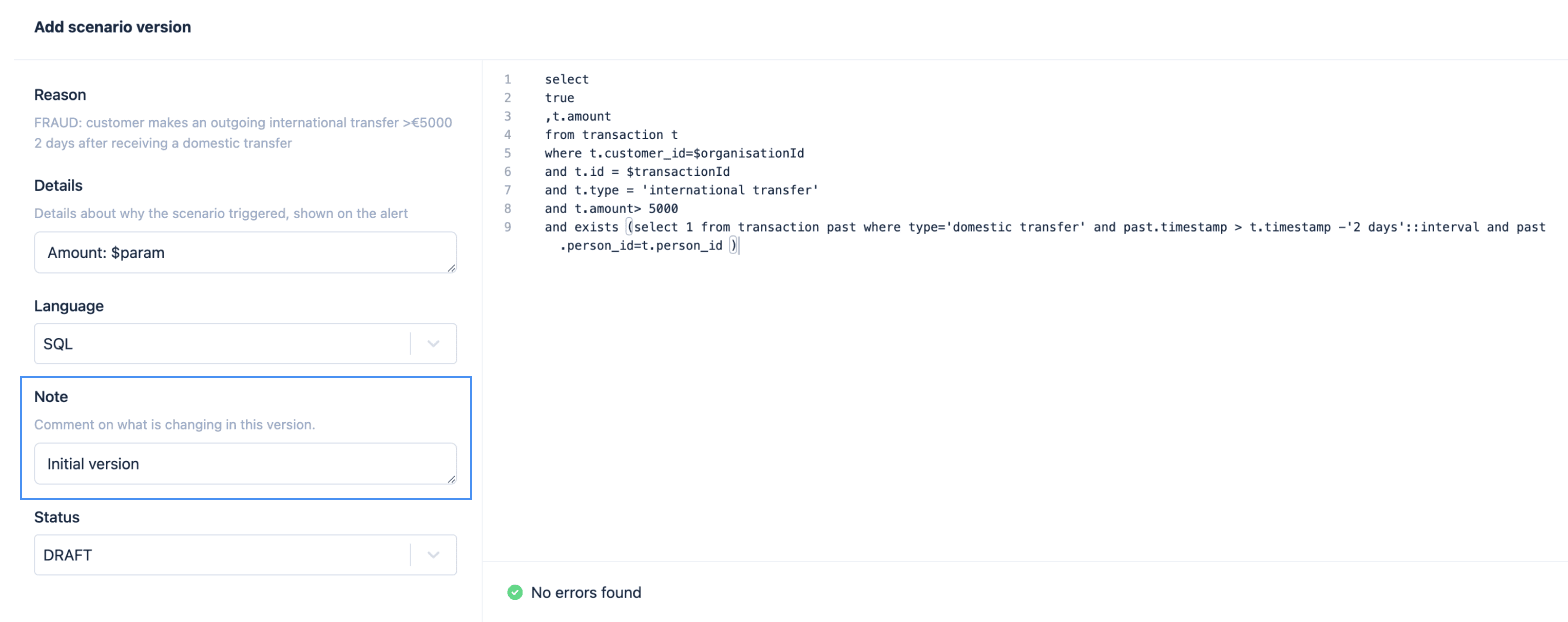

- Define the monitoring rule type, reason, and alerting interval all on the same page.

- Copy and paste the rule, either in JMESPath or SQL. You can specify the rule version in the note.

That’s it! You have now set up a new transaction monitoring rule. You can either keep it as a draft or change its status to live. From now on, you can access everything you need from the same page:

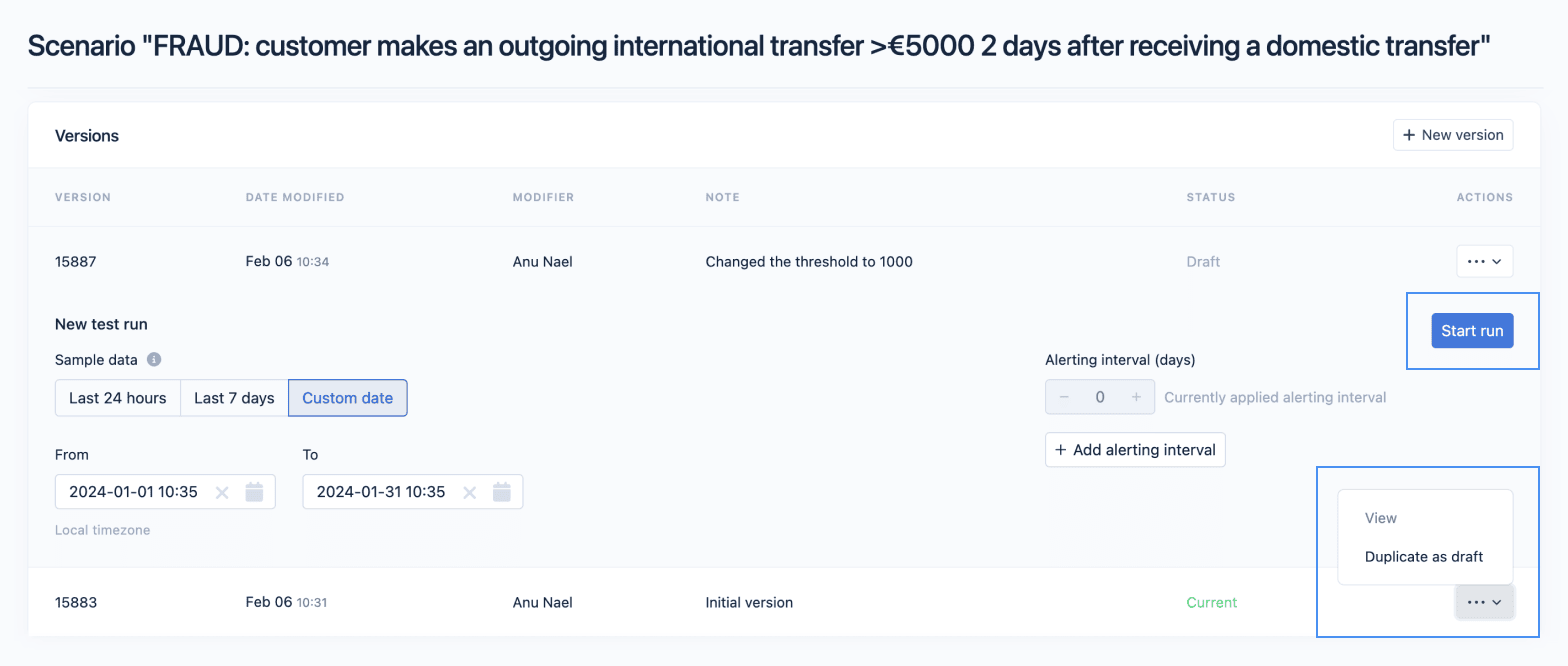

You can view your transaction monitoring rule, along with the transferred amount. If the transaction threshold changes, you can duplicate the draft, adjust the parameters and run tests. All versions and test runs can be accessed from the same page.

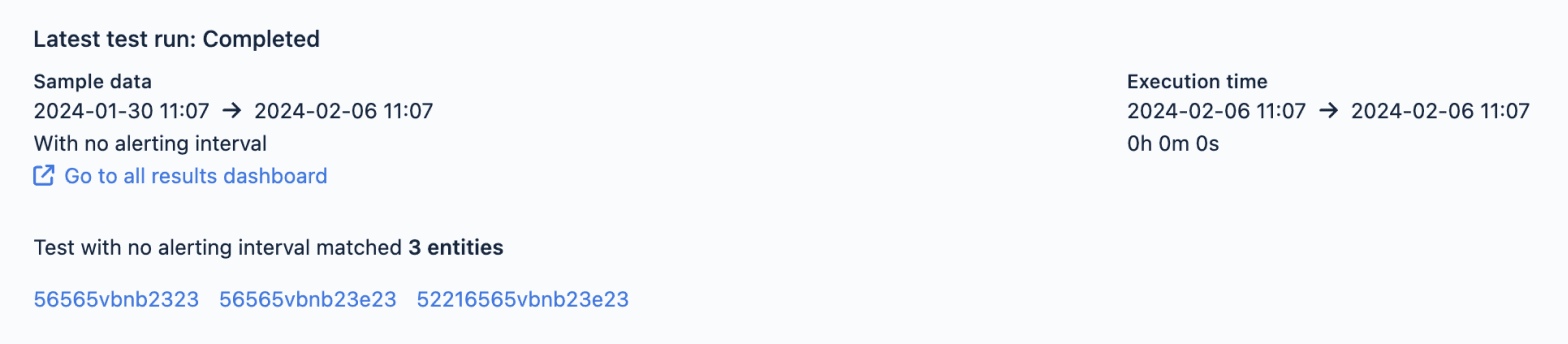

Our testing sandbox is an eye candy. You conduct tests using sample data from the last 24 hours, the last 7 days, or a custom date, and immediately review the results to see if any transactions match the test criteria.

Run tests from the same page.

You can immediately see the test results without leaving the page.

Choosing real-time transaction monitoring software isn’t a walk in the park. If dealing with fraud detection feels like an ongoing challenge, take a look at our article on picking the right fraud detection software. It dives into the nitty-gritty of various components of a fraud detection system, including real-time transaction monitoring.

Real-time transaction monitoring is just one tool at the disposal of financial institutions. In its 2022 report on partnering in the fight against financial crime, the FATF highlights the importance of information sharing between finacial institutions to enhance collaboration in the detection of suspicious activities, especially related to money laundering and fraud. Collaborative platforms like Salv Bridge show tangible results, boasting an 80% increase in the success rate of fund recovery thanks to early fraud detection.

Considering the ever-changing regulatory landscape, cross-border collaboration becomes crucial. Download our case study and discover how you can seamlessly integrate real-time transaction monitoring and information sharing for the real-time detection of fraud.