Find out how Juni transformed their AML compliance program

Read the case study

Financial criminals are fast — we’ve all seen how quickly they’ve rushed in to take advantage of the current world crisis. But, if you’re working in compliance, then “fast” isn’t a word you’d probably use to describe your work.

This UN’s research shows that over 99% of money launderers still get away with their crimes. Which means if we want to have any hope of changing that number, we’ll all need to get faster. At Salv, we think that actually means we’ll need to get way, way faster. Our anti-money laundering (AML) strategy must be bullet-proof.

What makes criminals so fast?

They power their work with cutting-edge technology

If you’ve ever heard of the dark web, you’re probably already feeling a little sick to your stomach thinking of the stuff that goes on there. But criminals rarely feel so queasy. Seedy, underground markets there offer everything they need — powerful technology, how-to forums, passwords and compromised accounts, and much more.

Exploitable channels are increasing exponentially

The biggest fintechs of today didn’t exist 10 years ago. And, for every challenger fintech you know — and maybe love — there are a thousand you’ve never heard of. While so much choice is incredible for consumers, it’s also more avenues criminals can use to launder their money through our finance system. If AML were a game of chess, you could say that criminals have the first-move advantage.

Compliance teams have less time to investigate money laundering because money moves faster

Wise (formerly TransferWise), a company I worked 5+ years for, notes 25%+ of their transfers in Q1 of 2020 arrived instantly — in 20 seconds or less. That means, increasingly, your team and technology may have less than 20 seconds to make a decision before your customer’s money is deposited into their recipient’s account on the other side of the world. This is great for customers, but, unfortunately, also great for criminals.

Large budgets + no need to follow the rules

Imagine if your compliance team had an unlimited budget and no AML regulations or constraints? With a nearly barrier-free existence like that, I’m pretty sure you’d be moving a lot faster, too. Those are the criminals of today.

How can compliance teams keep up?

If we’re all doing the best we can to keep up with changing AML directives and new technology, how can we make “faster” a reality? How can we increase our speed not just by 10%, but more like 10x to catch today’s tech-savvy criminals?

There are many workflows that can increase our speed.

- How quickly automated transaction monitoring scenarios can be updated

- How fast and how often financial institutions collaborate on AML cases

- How fast and how much feedback local police give to financial institutions about the Suspicious Activity Reports (SARs) that they submit

All 3 areas are critical, and, at Salv, we’re working on all 3, but for this article let’s just look at the first way compliance teams can speed up. This aspect is 100% within your control.

How to pivot your team’s AML controls way faster

As criminals learn our financial controls, they adapt to get around them. But it’s not that they change just once every few years — they change on a monthly or weekly basis. Which is why it’s critical that compliance teams keep pace. You get it.

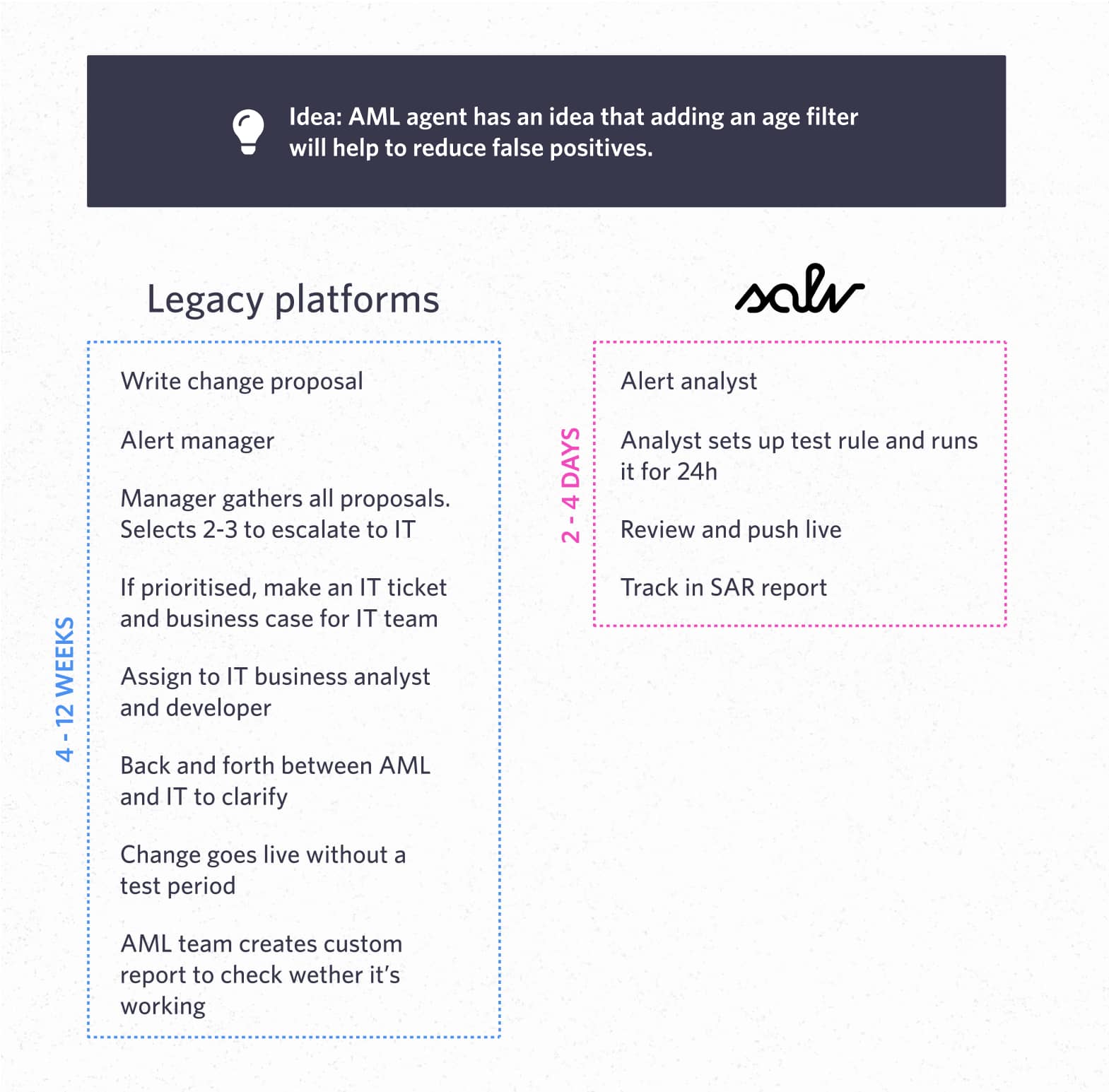

So one easy — yet vital — thing you can do to make sure your team is poised to beat financial crime and money laundering is to make sure your process of changing your transaction monitoring rules is as fast as possible.

Unfortunately, as we’ve consulted with many financial institutions to date, we’ve discovered it can take many of them not just weeks, but sometimes up to a year to update scenarios. They’re dependent upon IT/engineering, internal bureaucracy, or third party vendors to make the change.

Today our transactions reach breakneck speed. In 2021 alone, Salv’s AML Platform either screened or monitored over 100mn transactions. Changing a rule needs to be hours, or — at most — tested and in production within a week. In AML compliance, we have to do everything we can to reduce our dependencies and be nimble. We need technology that puts the power into the hands of those closest to the criminals and their patterns — AML agents and analysts.

Today our transactions reach breakneck speed. In 2021 alone, Salv’s AML Platform either screened or monitored over 100mn transactions. Changing a rule needs to be hours, or — at most — tested and in production within a week. In AML compliance, we have to do everything we can to reduce our dependencies and be nimble. We need technology that puts the power into the hands of those closest to the criminals and their patterns — AML agents and analysts.

Adding, changing, and testing rules needs to be a weekly occurrence if you want to have any chance at beating well-funded, ruthless financial criminals. If your compliance team is only updating or adding rules a few times per quarter — or, worse, per year — then you can be sure criminals are getting past you constantly. By the time you’ve changed your scenarios, they’ve already changed their game 5x over.

And, as a bonus, constantly fine-tuning your rules means you’ll stop less of your great customers — keeping them, and your revenues, much happier.

Perhaps at this point you may be wondering, “but what about Artificial Intelligence (AI) and Machine Learning (ML) — isn’t that the perfect solution?” We won’t go into depth here, but, honestly, we believe ML is NOT the answer for AML. Yet.

Get ahead of criminals with Salv

If you’re in AML compliance, then I want to personally thank you. You’re on the front lines every day, working to beat the bad guys and put a halt to the potential victimisation of millions. Thank you for everything you’re doing to help.

We’ve been there, too. Both myself and Taavi, Salv’s CEO, learned to beat financial fraud at scale with ⅓ of the world’s paid telecommunications at Skype. From there, Taavi and several other Salvers went on to set up the compliance teams at Wise. There, we learned not just how to beat financial crime in AML, but to navigate criminal patterns and regulators all over the world as Wise launched a new market in a new country every few weeks.

Wise and Skype were version 1. Salv is version 2. Our mission is to stop financial crime and money laundering by giving financial companies the speed and flexibility they need to get ahead of financial criminals.

You’ll have to see it to believe it.

Salv’s core AML platform helps you meet your organisation’s compliance needs, and equips you to detect money laundering and actively fight it. Book a demo to learn more or read our case study about how Juni transformed their AML compliance process with Salv.