Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn moreSalv is an AML software vendor pioneering collaboration in the financial services industry. Its products, spanning sanctions screening and monitoring of both customers and transactions, and customer risk scoring, remove complexity, automate, and streamline anti-money laundering (AML) and know-your-customer (KYC) compliance.

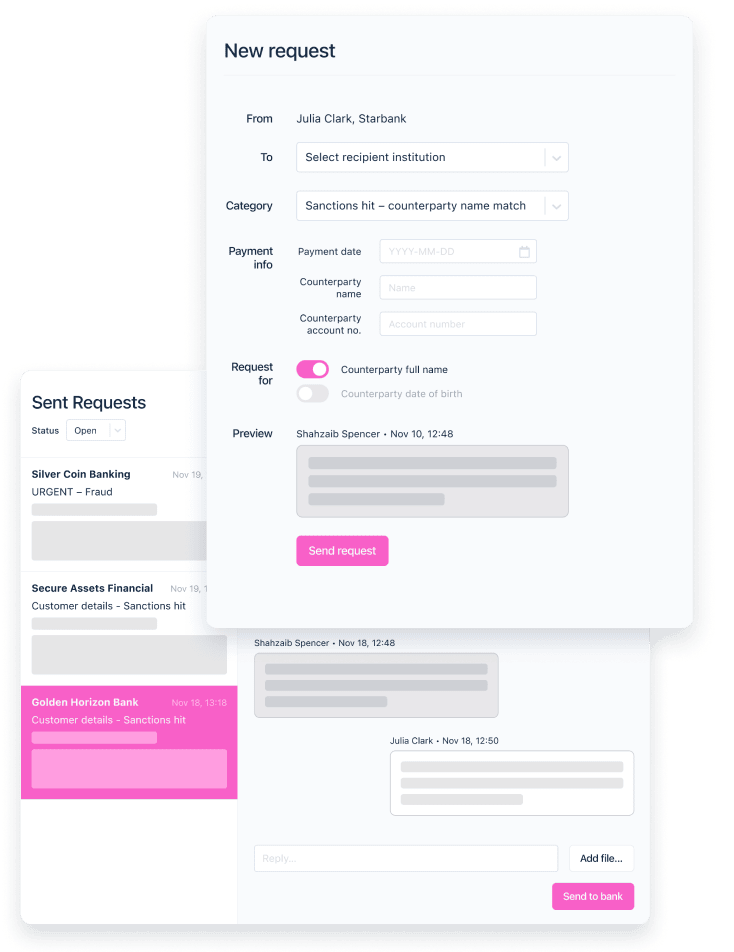

Salv Bridge differentiates Salv from the rest of the industry – by enabling financial institutions and banks to initiate collaborative investigations, detect and investigate fraud in real-time, and improve the success rate of the recovery of funds up to 80%.

While Salv offers unparalleled benefits, it’s worth considering alternative AML software vendors and choosing the one that is best for you. These alternatives may not encompass the full range of Salv offerings, often focusing on just one aspect or another. You should carefully consider your specific needs before moving forward in your search.

This article describes Salv alternatives & competitors, focusing on sanctions compliance and fraud risk management, and shares advice on how to choose the right Salv alternative for your business.

Disclaimer: Data and information contained in this report was collected from online sources during December 2023. If you want to learn more about how this report was written, or about the providers and services we discuss, get in touch.

What does Salv offer?

Salv takes a new approach to AML and KYC compliance, rooted in collaboration. Its modular products cover core compliance allowing financial institutions and banks to screen customers and transactions – against sanctions, PEP, and adverse media lists. Such modularity enables monitoring of customers and transactions, automated with advanced rules for real-time and post-event transaction monitoring. It comes with a powerful rule-building functionality, allowing users to create and test screening and monitoring rules using the built-in configuration tools.

Every parent thinks their baby is special, and so do we. Salv’s unique approach is underscored by Salv Bridge, a collaboration platform for financial institutions, enabling real-time detection of fraud, including authorised push payment (APP) fraud in the UK. The platform allows fincrime teams to initiate collaborative investigations, offering a new approach to the recovery of funds lost to fraud. Salv serves a plethora of customers from large banking groups to fintechs and virtual service providers (VASPs). In 2023, Salv’s clients reported an overwhelming 80% increase in the successful recovery of funds.

Collaboration in financial services is a relatively new trend that, at the time of writing this article, has not yet gained significant attention. In this article, we will discuss sanctions compliance and fraud risk management.

Sanctions compliance

Salv Screening is designed for firms aiming to reduce manual sanctions work, along with false positives, while keeping confidence in their sanctions compliance. In Salv, you can screen both customers and transactions against sanctions, PEP, and adverse media lists, irrespective of the number and complexity of data fields. Both customer and transaction alerts are visible in the same view, making it possible to resolve multiple alerts with a single decision.

Transaction screening positions Salv as comprehensive, out-of-the-box solutions for sanctions screening. Depending on your organisation’s needs and preferences, Salv will process and screen reference and transactional data. Our library contains dozens of pre-defined screening rules for person and transaction reference screening, transaction counterparty name screening, and transaction counterparty bank name or BIC code screening. Built-in configuration tools allow for testing and validating screening rules in the sandbox environment, risk-free to your business.

Fraud risk management

Salv’s products provide firms with a holistic approach to combating fraud and bolstering their fraud risk management.

Salv Monitoring combines a dynamic rules-based engine and built-in configuration tools to detect fraud in real-time payments and post-event. It enables firms to monitor customers, including customer risk levels and predictions of future behaviour. Additionally, Salv uses fuzzy matching for name matching in transaction monitoring to identify fraud in third-party payments.

Firms can create and test transaction monitoring rules using a combination of risk and screening results, internal compliance knowledge, exclusion lists or multiple country lists, as well as know-your-customer (KYC) and know-your-business (KYB) data. Our clients use Salv Monitoring to monitor payments processed via Swift, SEPA Transfers & Instant, Faster Payments, BACS, Direct Debits, making it an essential component in their fraud risk management strategies.

Salv Bridge is a collaboration platform for financial institutions. With Salv Bridge, fincrime investigation teams across multiple institutions can initiate collaborative investigations and work as a single team. Endorsed by the Financial Action Task Force (FATF) as one of the top eight collaborative initiatives worldwide, Salv Bridge has demonstrated its effectiveness in the recovery of funds lost to fraud. Large banking groups, fintechs, and VASPs have reported an increase in the success rate of the recovery of funds up to 80% using Salv Bridge.

List of Salv alternatives

- Oracle – Sanctions screening software

- Moody’s Analytics – Sanctions compliance

- Dow Jones Risk and Compliance – Sanctions compliance

- GSS – Sanctions screening through collaboration

- ComplyAdvantage – AI-driven fraud risk management

- Feedzai – real-time transaction monitoring and fraud prevention

- Verafin – payments fraud detection for enterprise clients

- Unit21 – real-time transaction monitoring

8 Salv alternatives

Oracle

Great for: real-time screening, sanctions compliance

Oracle is a provider of enterprise software products, offering solutions ranging from AML and KYC compliance to cloud infrastructure and data management. Oracle employs responsible artificial intelligence (AI) to optimise AML program performance and manage risks, while maintaining data integrity. Its sanctions screening solution encompasses the entire customer lifecycle, including real-time screening against global data sources, across multiple touchpoints.

Oracle combines sanctions screening with transaction monitoring against lists of sanctioned individuals and companies. This integrated approach positions Oracle as a leading provider of sanctions screening software.

Moody’s Analytics

Great for: sanctions compliance, third-party risk management

Moody’s Analytics provides financial intelligence and analytical tools to over 40,000 leading market participants including asset managers, banks, and corporates. Its comprehensive solutions span from sanctions compliance and intelligent screening to fraud prevention and third-party risk management. Moody’s Analytics’ approach to sanctions compliance focuses on data management, delivering comprehensive data ownership and control data with more than 445+ million entities worldwide. This enables companies to conduct deeper investigative research into sanctions-related risk, incorporating ownership and control information to present a full view of sanctions exposure. Additionally, its AI-powered name matching, with customisable search filters, optimises the identification of relevant risks.

Dow Jones Risk and Compliance

Great for: sanctions compliance, third-party risk management

Dow Jones Risk and Compliance is a global provider of risk management and compliance solutions, encompassing AML and KYC compliance, sanctions compliance, and third-party risk management. Its sanctions compliance solution offers comprehensive sanctions coverage, including global sanctions lists, sanctions control & ownership data, sanctioned vessels, and structured reference data for regions, sub-regions, seaports, and airports. This data is continuously monitored and updated to reflect changes made by international governments and bodies, facilitating both customer and transaction screening.

Dow Jones Risk and Compliance’s aggregated watchlists help reduce operational delays by minimising the number of duplicate alerts. Its customers include large banking and financial services companies such as Hobson Prior International and ICBC Standard Bank.

GSS – Global Screening Solutions

Great for: collaboration-based sanctions screening, real-time sanctions screening

GSS – Global Screening Services addresses cross-industry challenges with end-to-end, collaboration-based sanctions screening. It uses cloud-native technology to streamline the screening process, and provides flexible configurations to meet specific risk appetites. Financial institutions that have access to the GSS cloud environment, can share information and decisions relating to the investigation of alerts, thus reducing duplications along with false positives. Real-time sanctions screening by GSS provides responses in real time, allowing users to meet SLAs relating to instant payments.

ComplyAdvantage

Great for: fraud risk management, fraud monitoring

ComplyAdvantage is an AML software vendor with expertise in fraud monitoring and fraud risk management. Its fraud detection solutions harness the power of AI to identify and prevent fraud in payments across a range of payment fraud scenarios. Companies use ComplyAdvantage to monitor payments, including in real time, to detect changes in behaviour and uncover account takeovers and synthetic identity fraud, as well as to detect authorised push payment (APP) fraud through a combination of behavioural analytics, time sequencing, and graph network analysis.

Feedzai

Great for: real-time transaction monitoring, fraud prevention

Feedzai is a fraud prevention platform focusing on transaction fraud across multiple channels and payment types. Its omnichannel approach enables the detection and prevention of fraud throughout the customer journey, using real-time transaction monitoring in combination with behavioural and transactional pattern-scoring models. The platform offers a high level of granularity in the detection of APP fraud and scams. Tailored for both retail and corporate banks, as well as fintechs, PSPs, and acquirers, Feedzai positions itself among the leading fraud prevention companies.

Verafin

Great for: payments fraud detection for enterprise clients

Verafin provides enterprise-grade solutions for AML and KYC compliance, with an explicit focus on payments fraud detection. Verafin’s consortium data approach combines cross-institutional data to reduce false positives and deliver insights into counterparty risk. It enhances existing transaction monitoring systems with real-time interdiction to release or reject a payment directly from an alert or case.

Verafin’s proprietary database of suspected fraudsters and money mules, specialising in APP fraud, is based on real-time feedback from our consortium of thousands of financial institutions.

Unit21

Great for: real-time transaction monitoring, fraud risk management

Unit21 is a provider of AML compliance software that solves real-time transaction monitoring and fraud risk management for Fortune 500 companies, including both traditional banks and digital banks, payments companies, and fintechs. Unit 21’s transaction monitoring delivers proactive protection against real-time threats, enabling companies to analyse real-time data across transactions, behaviours and networks. The platform’s functionality allows for instant modification of rules for detection and prevention of both first-party and third-party fraud.

Salv stands out with its innovative approach to collaboration between financial institutions, enhancing sanctions compliance and fraud risk management practices across large banking groups, fintechs, and VASPs. This collaboration-based approach, pioneered by Salv Bridge, has been particularly effective in tackling APP fraud, resulting in increased recovery rates of up to 80%.

However, there are multiple alternatives and competitors to Salv that focus on different aspects of compliance, such as sanctions compliance and fraud risk management. Companies like Oracle, Moody’s Analytics, Dow Jones Risk and Compliance, and others, offer tailored solutions to customers depending on their industry, size and specific business needs. If you know what you are looking for and think we can help – get in touch with our expert team.