“My life’s dream has always been to follow loads of rules. That’s why I joined the compliance industry.”

Said no one. Ever.

I’m Taavi, the CEO of Salv, a crime-fighting anti-money laundering (AML) platform — and I’ve been in compliance for years. And, let’s be frank, I know from talking to so many over the years that no one joined just to follow a bunch of rules. Most of us got into the compliance industry because we wanted to make a difference. We wanted to put an end to money laundering and terrorist financing. But, how does that feel in our daily work life?

And what is compliance, anyway?

Defining the word compliance

Let’s look at that word compliance for a second. I’m betting most of us haven’t looked it up in a dictionary recently.

If you read through the definition, you can almost summarise compliance like this:

- Giving up.

- Giving in.

- Going along with [a system we all feel helpless to stop].

Compliance really is a passive word. And, if you pay attention to how you feel reading it, you probably don’t feel really great afterwards. Plus, in the compliance industry we all know we can’t really afford to be passive with trillions of dollars of dirty money laundered through the banking system. And so, at some point, regulators realised they had to do something about it.

The original point of compliance

Compliance laws were first introduced in the 1930s in the United States. And, back then, in the midst of mafia, gangster-controlled American neighbourhoods and rampant fear, the new laws had a pretty clear purpose.

Compliance rules meant to:

- stop crime

- stop criminals

- protect the innocent

A noble cause we can all get behind. But, somewhere over the last century, the original mission has been replaced by something else. Something that, at Salv, we’ve taken to calling the Compliance Ferris Wheel.

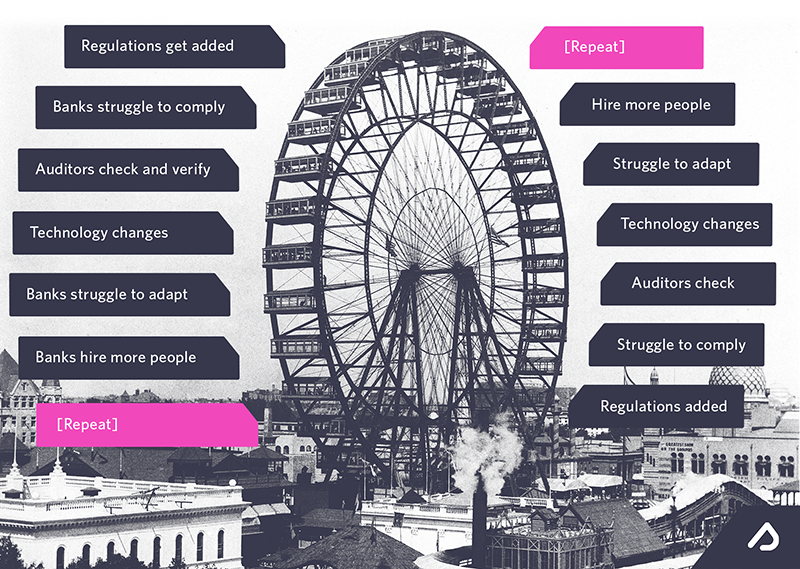

The compliance ferris wheel

Especially if you’ve worked in the compliance department of a bank for awhile, this cycle is probably all too familiar.

- Regulations get added.

- Banks struggle to comply

- Auditors check & verify

- Technology changes

- Banks struggle to adapt

- Banks hire more people

- Repeat.

Over and over. Round and round. The Compliance ferris wheel never seems to stop. Add on regulations that are being added at an unprecedented rate — AMLDV and VI, anyone? — and you may already feel the exhaustion and hopelessness many in the compliance industry.

Powerless to stop it. Powerless to make a difference. And even a little queasy.

This compliance ferris wheel represents the fact that we’ve lost our way a bit. That original intention of stopping crime, stopping criminals, and protecting the innocent? All too often, it’s become just a tick box exercise — a reluctant fact that we all hate that.

On top of all of this, keeping up with changing regulations and technology on top of an increasing amount of AML scandals means it’s now really hard to be on a compliance team. Still, even with all of this hard work, an estimated 99%+ of money launderers get away with their crimes.

It’s heartbreaking.

So what else can we do?

The answer is simple: fight financial crime.

Go from passive compliance to active crime-fighting

Go from passive compliance to active crime-fighting? Maybe this sounds like a no-brainer, but in our experience, it isn’t. As we search around, a vast majority of the tools out there to help compliance teams with their AML are still built to, well, stay compliant.

In Salv, myself and my co-founder Jeff built up the anti-fraud engines in Skype and then I took that basis of active crime-fighting and built up the compliance engines in Wise (formerly TransferWise). It was there that I saw that primarily focusing on active crime-fighting — even in AML — worked. The only thing we needed to make sure of is that our tool was regulator-friendly enough so that when auditors came knocking, we could show why we made the decisions we made.

What will be the next big trend in AML? Read about Salv’s counterparty monitoring.

So that’s how Salv came to be. We saw other companies out there, still struggling to stay compliant while not prepared at all to fight the increasing amount of crime pummelling their systems. And we couldn’t stand idly by and watch them drown under increasing regulations while not making a dent in financial crime itself.

So if that’s you, struggling and ready to get off the compliance ferris wheel — reach out or book a demo right now.

Crimefightingly yours,

Taavi Tamkivi

Salv Founder, CEO, & Professional Crime-fighter