Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn moreHave you ever wondered why handling RFIs is such a tedious and time-consuming process? In the end, it’s a simple request from one financial institution to another, which helps you to identify bad actors and prevent them from using your systems.

Despite the growing adoption of information-sharing initiatives, for many in the finance industry, the RFI process remains the primary communication channel between banks and their fintech clients.

The current approach to the RFI process is characterised by operational inefficiency and lack of automation. It’s excessively time-consuming and requires a large investment to develop and maintain the process framework.

Transaction Monitoring Request for Information (RFI) Best Practice Guidance by the Wolfsberg Group stresses the importance of collaboration in handling RFIs, and encourages communication and information exchange between financial institutions.

An important goal of this blog post is to clear up uncertainties surrounding the existing approach to the RFI process and outline measures to address all the associated blockers and concerns.

RFI process at a glance

In the majority of cases, the RFI process is carried out via email. Charlotte or Daniel from your compliance team is likely to attach an Excel spreadsheet expecting your fintech client to fill out the necessary information. As you can see, it’s still a manual process that is less efficient and more prone to human error, especially when it comes to screening-related RFIs (because the screening volumes are pretty high).

Sending out RFIs like this can add further delays and frustration, threatening to upset the delicate balance between customer satisfaction and functionality of the product.

_compressed.jpg)

Things become more complicated when it comes to transaction monitoring. The process is less standardised and requires a more consolidated approach, simply because you need more information to resolve a monitoring alert.

You may think that building an internal customer portal is a good idea. It could provide better oversight of the RFI process, allowing your fintech clients to receive and respond to RFIs, and track the status of individual RFIs.

However, it’s not as easy as it may seem. One limitation of this approach is the pressure to develop and maintain an in-house solution, another to integrate multiple solutions.

Benefits and value of the RFI process

The RFI process enables you to detect and investigate potentially suspicious activity and mitigate financial crime risks originating from your fintech clients, because you don’t have access to Know Your Customer (KYC) information.

The process gives you valuable insights into:

- Resolution of screening and monitoring alerts

- Enrichment and advancement of investigations

- Handling of fraudulent transactions

Resolution of screening and monitoring alerts

Most of the RFIs are triggered by or related to name matching in sanctions screening, either on the sender or recipient’s name. Other cases include payment reference keywords related to the trade sanctions and the status of the issuing and the beneficiary bank. If either of the banks is under sanctions, the transaction cannot be completed.

To clear up a name match, you need the sender or recipient’s full name and the date of birth. You can’t (and probably wouldn’t want to) reach out to the customers of your fintech client, simply because you don’t have access to their KYC information.

Enrichment and advancement of investigations

One day, Daniel or Charlotte (your compliance agents) may come across a suspicious customer or transaction and wonder, is there more to it than that? One of them will write an RFI email and press the send button, thus initiating the RFI process.

In a way, we can say that the RFI process exists to facilitate the communication between your bank and the customers of your fintech client.

Handling of fraudulent transactions

As a bank, you are responsible for initiating the RFI process, but not when it comes to consumer fraud. In that case, your fintech clients must take the first step and alert you of possible fraudulent activity.

Managing the consequences of the fraud is a complex process with multiple steps:

- The customer notifies your fintech client of possible fraud

- Your fintech client takes measures to trace the funds

- Your bank steps in to assist in the recovery of funds

With the right approach to the RFI process, you can establish a more direct and transparent channel of communication, which will help you to resolve fraud cases faster and increase the chances of recovery of any misappropriated funds.

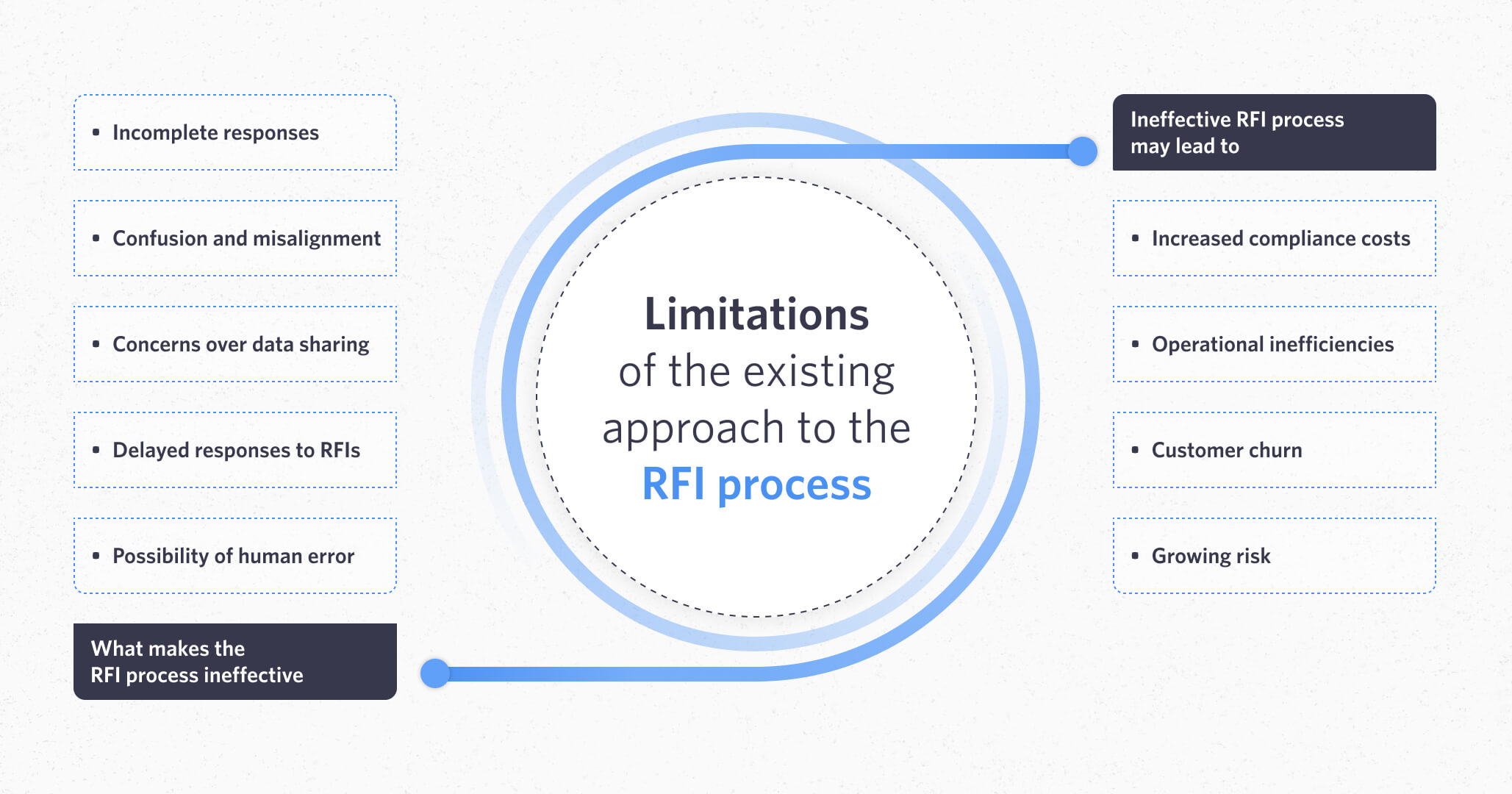

Limitations of the existing approach

It’s a time-consuming, costly process. Imagine the effort of putting together and sending an Excel file, then waiting for hours until someone fills it out and sends it back.

You can’t automate it based on the Excel file. The only solution is to build an in-house RFI management system.

Even then, there is no guarantee that all of your fintech clients will be willing to integrate it.

It’s inefficient and frustrating to everybody. A single RFI can turn into hours and even days of back-and-forth communication with no resolution in sight.

What about the customers? All the while, the transactions in question are on hold, which means the senders or recipients may be giving a hard time to your fintech client’s online support team.

No one likes dealing with upset customers. And, who knows, maybe your fintech client has already started looking into alternatives to your service.

Turning limitations into strengths

Everything could have been different if only you had made certain changes, and changed the way you communicate and exchange information with your fintech client.

In the ideal world, what you need is a collaborative, open, and honest approach.

What you are probably looking for is…

A fast and reliable process that generates more value than it costs. A dedicated channel to initiate and manage all RFIs in a unified manner, using customised templates to collect information and act on it immediately.

Automating the initiation of RFIs. It’s technically possible to automatically initiate RFIs via a centralised RFI management system integrated directly into your core tooling.

Likewise, your fintech clients can automatically respond to RFIs – essentially using the same approach.

It’s all about efficiency. Using a single hub to process all RFIs offers a way out of the sloppy and harmful process by streamlining the RFI process and making it more structured and transparent.

Putting the customer first and ensuring a high level of excellence. Handling RFIs in a timely manner means the transactions are suspended for shorter periods of time, which also means that you are getting less “Where is my money?” calls.

…and it’s closer than you think.

Concerns about having a single RFI management system

You can’t have it all, goes the mantra. It’s time we busted some common myths about a single RFI management system and why no one would ever use it.

It’s “just another tool”. You don’t want to modify your processes in order to accommodate a new product. You don’t have enough evidence whether it can improve things now, or in the future.

What you probably need is a tool that can be easily integrated with your existing CMS system like Zendesk, and manage all communication from one place. A tool that is user-friendly and considerably more consistent.

It’s hard to integrate. You think it’ll take a lot of work integrating all of your fintech clients, with no guarantee of return on the investment.

You need a solution that is easy and quick to learn and use. A solution that can be integrated using a single API call and has an encryption layer to allow you exchange information in a secure and compliant manner.

Believe it or not, such technology already exists.

It doesn’t increase transparency. There is not much transparency surrounding suspended transactions, neither for your fintech clients nor for their customers.

This lack of transparency may damage relationships with your customers and increase the churn rate, but not for the banks directly. Frequent delays in the RFI process may cost you customers when they leave you for another vendor.

Your operational team is already underwater. You don’t have the resources to integrate a different solution, and your risk appetite to “test new waters’’ is low. Besides, it’s safer to maintain the status quo rather than gamble on the stability of your current system.

What you probably need is a system that can take pressure off your operational team and help you balance customer experience and cost.

Closing the gaps between banks and fintechs

We have busted some myths about having a single RFI management system, and now it’s time to give it a name.

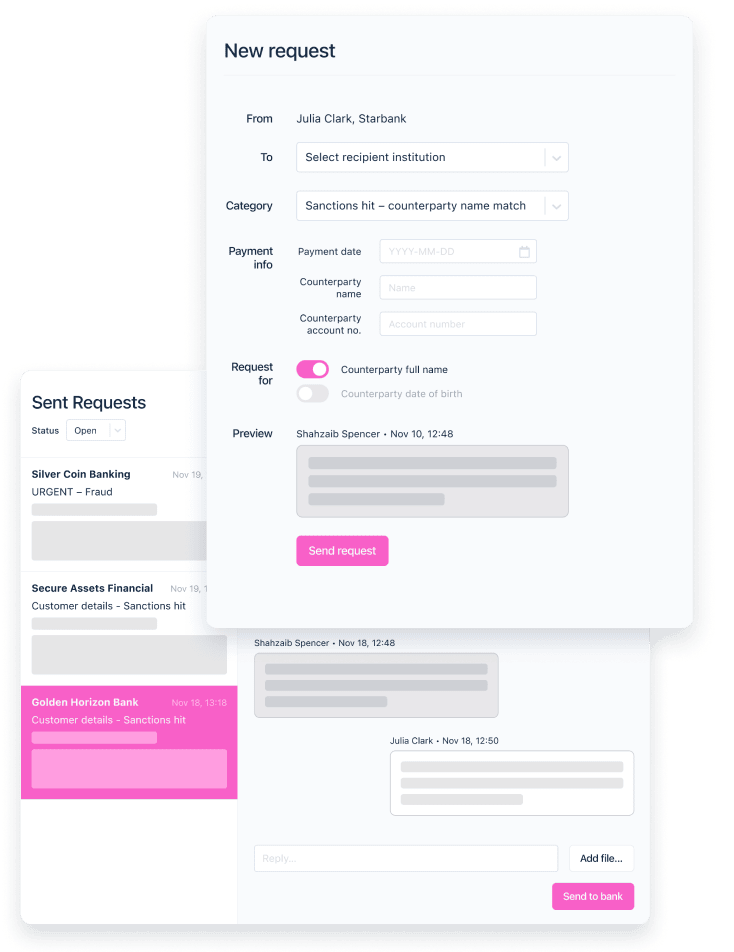

Salv Bridge is the only tactical information-sharing platform that provides you with ample opportunities to compose, send and respond to RFIs in real time, enriching your investigations with accurate third-party insights and reducing the impact of compliance checks on your customers.

How does it work?

Salv Bridge acts as a single communications channel embedded into your compliance workflow. It gives you a direct point of contact with all of your fintech clients, reducing case resolution time from days to minutes. You can further automate the process by using our new powerful API and customisable messaging features.

You can test the system without prior integration, however, know that once you make up your mind, we can quickly integrate it into your core tooling. Your fintech clients can use one single integration for multiple partner banks, which, in the long run, will convert into revenue you both have been missing on.

Really, how does it work?

We don’t throw words out into the electronic vortex hoping someone would pick up our song. Instead, we want to demonstrate that we are the company you can count on.

Just last year, we finished a successful integration of the two of our long-standing customers, a large financial services company, and their fintech client, a global open banking company. For convenience’s sake, we’ll refer to them as the bank and the fintech.

That’s when the bank’s email-based RFI communication went through a transformation from a clunky and time-consuming process to a quick and prompt knowledge exchange.

That’s when things really got rolling.

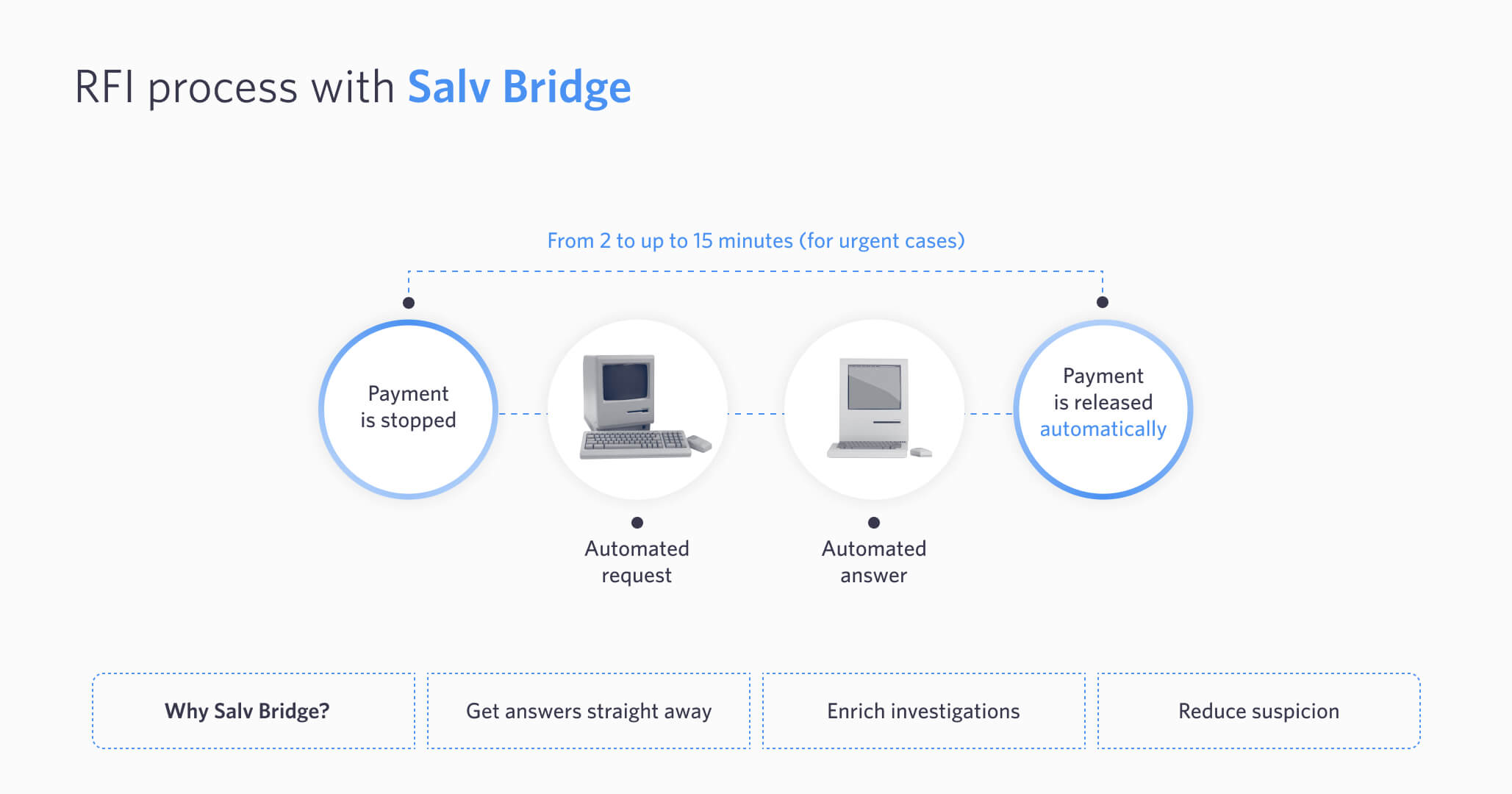

Both the bank and fintech use Salv Bridge to initiate, receive and automate RFIs, which, in turn, allows them to resolve cases in mere minutes.

The below example illustrates how it works in name matching:

- Initiate: By now, 100% of the bank’s name matches trigger an automated standard RFI to the fintech. No need to wait until your compliance agent returns from lunch break.

- Receive: Upon receiving the RFI, the system runs an automated check on the fintech’s side to see if they have the requested information.

- Automate: In 50-70% of the cases, the fintech already has the requested information, which would generate an automated response.

- Resolve: The bank receives the information and rescreens the transaction in question. In 95% of the cases, the matches are automatically solved because the match does not exist anymore. Your compliance agent is still at lunch.

As you can see, the whole exchange can take mere minutes. It’s shorter than an average watercooler chat.

We have a saying – the less you know, the better you sleep. But if you can’t gather enough information about your customers and their financial activity, you can’t provide them with a good service, which means that eventually you will fail in your obligations as a financial services provider. So we have another saying for you:

The more you know, the better you sleep.

To make effective use of your RFI process, you must focus on automating the initiation of RFIs and making the process more structured and transparent. Always put your customers first and think about the value of your current approach in the long term.