Investigate and solve fraud, and increase recovery rates up to 80% with Salv Bridge

Learn moreCollaborative crime-fighting relies on the information exchange between regulators, financial institutions, and law enforcement agencies. It allows parties to exchange and enrich data on bad actors, actively detect and counter money laundering, fraud, and other financial crimes.

Collaborative crime-fighting can take place within public-private partnerships and private-private partnerships, where it supports greater insights and greater criminal justice outcomes through collaboration and co-development of financial crime risk intelligence.

History of collaborative crime-fighting

Collaborative crime-fighting would not be possible without the frameworks laid out by FIUs. The first FIUs were set up in the early 1990s, following the establishment of the Financial Action Task Force. The primary purpose of FIUs is to gather and analyse suspicious activity reports (SARs) on cases related to financial crimes, including money laundering and fraud. FIUs are instrumental in preventing and investigating financial crimes on a local, national, and international level. In 2022, 160 FIUs compose an international network known as the Egmont Group of Financial Intelligence Units.

The effectiveness of FIUs largely depends on the mechanisms that enable them to cooperate and coordinate their actions within and across borders and jurisdictions, which include developing and implementing policies and activities to detect and prevent financial crime. The key to effective cooperation between FIUs is based on trust from their counterparts.

Since 2015, the introduction of public-private financial information sharing partnerships has led to improved effectiveness and efficiency in jurisdictions that have applied them. Recognising the importance of public and private sector cooperation to combat international crime, Europol decided to set up the first transnational public-private partnership for financial information sharing. Launched in 2017, The Europol Financial Intelligence Public-Private Partnership (EFIPPP) brought together experts from 15 major banks and competent authorities from eight EU member states and non-EU countries, involving FIUs, law enforcement authorities, and supervisors.

In 2018, the Egmont Group Plenary addressed the opportunities and challenges of public-private partnerships in connection with FIUs. The outcomes highlighted the role of public-private partnerships in fostering access to information, enhancing quality and trust, providing more flexibility and agility to adjust and respond to emerging financial crime threats, and developing new information sharing partnerships – both between and within the public and private sectors. There is still a long way to go to overcome legislative, security, and technological challenges, the plenary’s outcome document points out.

In October 2020, Estonia’s financial leaders initiated the first collaborative crime-fighting network called Salv Bridge. By 2022, Salv Bridge has grown into a functional cross-border tool that enables tactical information exchange across three use cases: fraud, money laundering, and sanctions. Initially, the network’s efforts were dedicated toward prevention, detection, and mitigation of money laundering. Salv, an Estonia-based regtech company, is credited with coining the term “collaborative crime-fighting”.

Challenges of collaborative crime-fighting

Financial institutions hold critical information on customers who may be involved in criminal activity, however, it is not always possible to raise timely alerts to law enforcement authorities. A lack of timely and accurate response may lead to large losses and serious, long-term reputational damage.

Despite the collective efforts of FIUs and cross-border information sharing partnerships, financial crime remains a pressing global issue. According to the UN, criminals launder between $2.5-4tn every year. Between 70-80% of this money is laundered through traditional banking structures. A 2019 review of Suspicious Activity Reports filed in Europe found that FIUs had the information they needed to act in only 10% of cases.

Financial crime is mostly facilitated by organised crime networks who also heavily rely on money laundering as a way to legitimise their proceeds. A networked environment makes it possible for a systematic cooperation between criminals, giving them an unfair advantage over law enforcement authorities. In order to stay one step ahead, financial institutions must have equal access to information about suspected financial crimes – and this is the purpose of collaborative crime-fighting networks.

Collaborative crime-fighting networks

In Estonia, collaborative crime-fighting has been pioneered by the four largest banks: Swedbank Estonia, SEB Estonia, Luminor and LHV (representing a 90% share of the domestic market). Together they formed the core of the world’s first crime-fighting network, later known as Salv Bridge. The Salv Bridge network was initiated with the full support of Estonia’s Financial Supervisory Authority, Data Protection Inspectorate, and the FIU of Estonia. As of 2022, more than 20 European banks and fintechs use the network daily.

Collaboration and operational principles

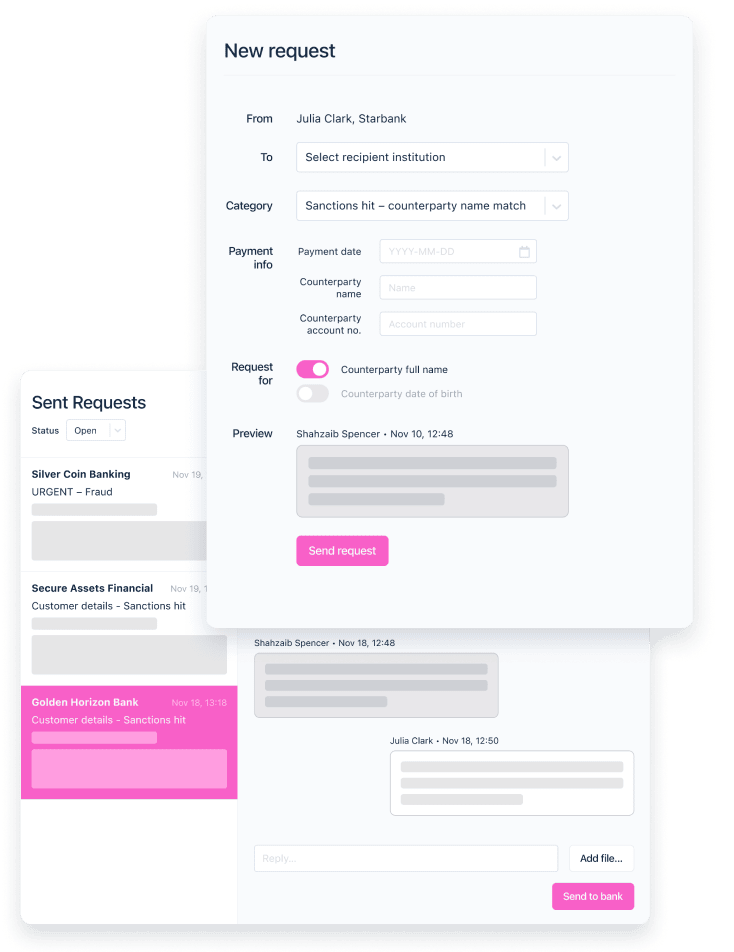

Salv Bridge operates on the basis of private-private financial information sharing partnerships. It provides a secure messaging channel that allows banks and fintechs to proactively share and exchange information about high-risk customers and transactions. This way, Salv Bridge provides a much bigger, smoother, clearer picture, and contributes to the development of financial crime typologies. It offers the capabilities that the private sector needs in order to respond to emerging threats.

Collaborative crime-fighting promotes increased cooperation between industry participants, and significantly reduces the investigation time. Salv Bridge eliminates potential security loopholes in interbank communication, and provides a structured system to manage incoming and outgoing requests for information (RFIs). It promotes close cooperation, trust, and regular communication between the network members.

Collaboration and impact

The initial outcomes of the Salv Bridge Estonia pilot showed a significant improvement in the quality of enhanced due diligence (EDD) procedures across the participating banks. We observed the reduction in major time-delays in both money laundering and sanctions cases. The banks reported solving urgent cases in between 3 and 15 minutes, which is a vast improvement on the previous 24-48 hour delays reported in the industry. With Salv Bridge, banks can expand oversight beyond their own customer data, and access evidence to uncover multi-institutional scam or money-laundering schemes.

As of 2022, Salv Bridge facilitated over 1200 collaborative investigations, preventing up to €3 million from reaching criminal-controlled accounts.

Legal framework of collaborative crime-fighting

The European Union’s General Data Protection Regulation (GDPR) has provided a clear legal basis for private-private financial information sharing across the 27 member states and the UK. The precise scope, as to what data, and in which instances it can be exchanged will often depend on nation-level AML/CFT legislation, provided that network members adhere to data-minimisation practices, and ensure that the data exchanged accords with principles of necessity and proportionality.

Supported by the Europe-wide legislative and regulatory developments, the upcoming AMLR/AMLD6 regulatory package will include provisions to enable information sharing across 27 member states as early as 2024.

There is growing policy and regulatory interest in collaborative crime-fighting. The following pieces of legislation focus on supporting more effective collaboration for the detection of money laundering risks and expanding private-private financial information sharing initiatives.

- FATF ‘Stocktake on Data Pooling, Collaborative Analytics and Data Protection (2021).

- The Netherlands 2019 “Joint Action Plan” on the prevention of money laundering (transaction monitoring and post-suspicion private-private sharing).

- 2019-2022 UK Economic Crime Plan (pre-suspicion and post-suspicion private-private sharing)

- The US 2021 Anti-Money Laundering Act and prescribed growth of FinCEN Innovation programmes.

- Singapore public consultation on a new ‘COSMIC’ platform and accompanying legislation – “Collaborative Sharing of ML/TF Information & Cases”.

Collaborative crime-fighting is gaining momentum across the world. If you have any questions, get in touch with us or book a demo.