Screen better, sleep better: 8-step guide to reduce manual reviews

I want better sleepIn 2022, governments around the world imposed unprecedented restrictions on Russia for invading Ukraine. This move is part of a broader pattern where international sanctions have become a more frequently used tool of foreign policy. While the effect of these sanctions presents a topic for another discussion, there is a clear upward trend in sanctions against Iran, Belarus, Myanmar, and North Korea. In response to global security threats, major sanctioning jurisdictions have expanded their sanctions lists by fivefold and more, with Canada reporting over 100% increase. As we move into 2024, with Russia as the most sanctioned country, governments are increasingly leveraging sanctions against human rights violators and global corruption, as data from Castellum.AI shows.

This trend presents a major challenge for regulated institutions as they try to stay on top of the evolving sanctions landscape and avoid costly violations. In this dynamic setting, sanctions screening has become an essential part of compliance in many industry sectors. This guide will explore the nuances of sanctions screening, giving you tools to identify potential challenges and build an effective sanctions screening process.

What are sanctions?

Sanctions are penalties imposed on a country, government officials, companies, and private citizens, for breaches of international agreements. Sanctions seek to force a change in political behaviour through a series of restrictive measures but essentially serve to pressure the targeted entities to comply with international laws. It is important to keep in mind that sanctions are temporary by nature and can be lifted once a sanctioned entity complies with all international laws and regulations, achieving a desired political effect.

What is a sanctions list?

Sanctions lists essentially are the instructions for regulated institutions that have a legal obligation to comply with sanctions screening requirements. They can can be applied to individuals, countries, and legal entities responsible for certain violations, including war crimes, terrorism, terrorist financing, drug trafficking, and proliferation of weapons of mass destruction. You should know that although the sanctioning bodies try to coordinate their strategy, their sanctions lists don’t always align.

Some of the prominent sanctioning bodies include:

The United Nations (UN) Security Council: Their sanctions have ranged from comprehensive economic and trade sanctions to arms embargoes and travel bans, and are binding on all member states.

The Office of Foreign Assets Control (OFAC): OFAC administers and enforces economic and trade sanctions against targeted foreign countries and regimes, which are applicable to all U.S. citizens and residents, as well as business entities, regardless of their location.

His Majesty’s Treasury (HMT): HMT governs the UK’s sanctions regime, affecting individuals and entities operating or carrying out activities within the UK’s jurisdiction. This includes a consolidated list of persons and organisations that are subject to financial sanctions.

The European Union External Action Service (EU EEAS): EEAS sanctions aim to safeguard the EU’s values, fundamental interests and security in connection with the Common Foreign and Security Policy (CFSP). Sanctions from the EU EEAS impact all EU citizens and companies established within the EU member countries.

Types of sanctions

The European Council defines sanctions as the measures designed to address conflicts and promote peace, democracy, and the rule of law. Restrictions can be applied on different levels and include diplomatic sanctions and the sanctions that require a specific legal basis in the EU Treaties. There are several types of sanctions that stand out:

- Diplomatic sanctions can involve severing diplomatic ties or a collective recall of EU member states’ ambassadors from the targeted country.

- Travel bans on identified individuals, prohibiting their entry into the EU or restricting EU nationals to their country of citizenship.

- Asset freezes for identified individuals or entities.

- Economic sanctions that might include import/export bans, investment restrictions, or prohibitions on providing certain services in specific sectors.

Common sanctions risks to organisations

For most regulated institutions, compliance with sanctions is a major pain point. It creates a tense, high-stakes environment, where every decision you make can have a potentially devastating effect on your business and operations. Without a system in place for customer and transaction screening, you put your company at greater risk of sanctions violations.

Failure to comply with sanctions can negatively impact your relationships with customers, partners, and regulators, potentially leading to long-term repercussions. For instance, in 2020, HSBC’s share price plummeted due to the allegations of money laundering, which resulted in a fine of £63.9m by the UK’s financial regulator. However, fines are not the only risk to your business. Violating regulations, even unknowingly, can lead to a loss of trust, harm your organisation’s reputation and credibility, and cost you customers in the long run.

Sanctions compliance is not just about checking boxes, targets, and numbers. You should make sure that your customers are screened on a regular basis to maintain compliance in the ever-changing sanctions landscape.

Advanced technology can greatly simplify your sanctions screening process. With sanctions screening software, you will identify areas of potential concern and make more informed decisions.

Sanctions screening components

At the start, you want to understand if the person or entity you are dealing with is on any of the sanctions lists. There are two ways to approach this:

Name screening

Name screening incorporates screening against sanctions lists. As the name suggests, it allows you to check individuals, businesses, including banks, and counterparties against global sanctions lists.

Reference screening

Reference screening is another screening strategy that allows you to look for potential matches in banking payment reference texts.

Reference screening requires more work: the system automatically checks and verifies every element in the reference, and if there is more than one mention of the same name, the screening results in multiple matches.

What can you do with sanctions screening?

An effective sanctions screening system is cost-effective and easy to manage. It helps you to reduce the friction for your customers by providing them with a convenient and safe experience.

You can do much more with sanctions screening, though.

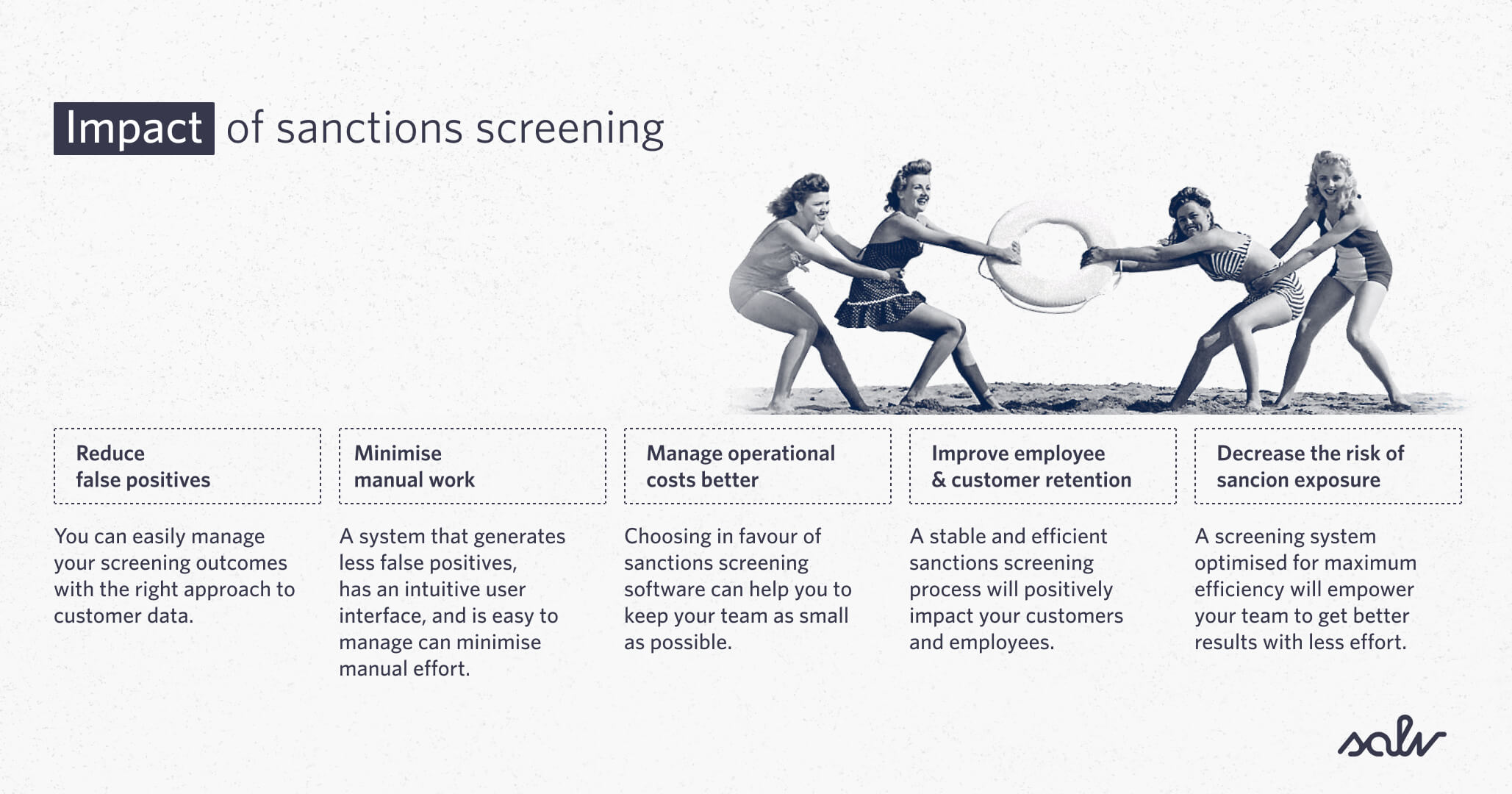

Reduce false positives

Incorrect, duplicate, or incomplete data in sanctions screening can generate a large number of false positive alerts. The best way to manage your screening outcomes is to understand and structure your customer data.

It is possible to achieve greater efficiency by automatically resolving false positives in your screening process. We’ll talk more about that below.

Minimise manual workload

Growing workload is one of the biggest concerns for everyone in the compliance industry right now. You may think that the easiest way to tackle this is to grow your compliance team until the point it matches the workload. But that’s not the only way.

You can effectively minimise the screening workload when you know exactly what you have to screen against. By understanding the regulatory requirements applicable to your business, you can adjust your risk appetite and screen intelligently, without overcompensating for a lack of knowledge.

A system that generates less false positives, has an intuitive interface, and is easy to manage can minimise manual effort and support your team to make a more meaningful impact.

Manage operational costs

High workload translates into higher costs for your business. Choosing in favour of sanctions screening software rather than relying on in-house resources can help you to keep your team as small as possible, while taking care of most, if not all, of your sanctions screening needs.

Improve employee & customer retention

Your compliance agents don’t want to work on mundane, repetitive tasks. Ensuring a stable and efficient sanctions screening process will not only have a direct effect on your customers, but also on your employees, their productivity and efficiency at work.

A sanctions screening system optimised for maximum efficiency will free up your compliance team to focus on more meaningful, higher-level tasks.

Decrease the risk of sanctions violations

There are nearly 100 jurisdictions that have imposed sanctions to date, so keeping abreast of what’s happening is a Herculean task. You need up-to-date data, coupled with the right screening technology, to avoid fines and balance your resources and spending.

Integration with Salv Bridge, a platform for collaborative investigations, allows you to reduce fraud losses through early detection. Learn how it brings together fincrime investigation teams across large banking groups, fintechs, and VASPs.

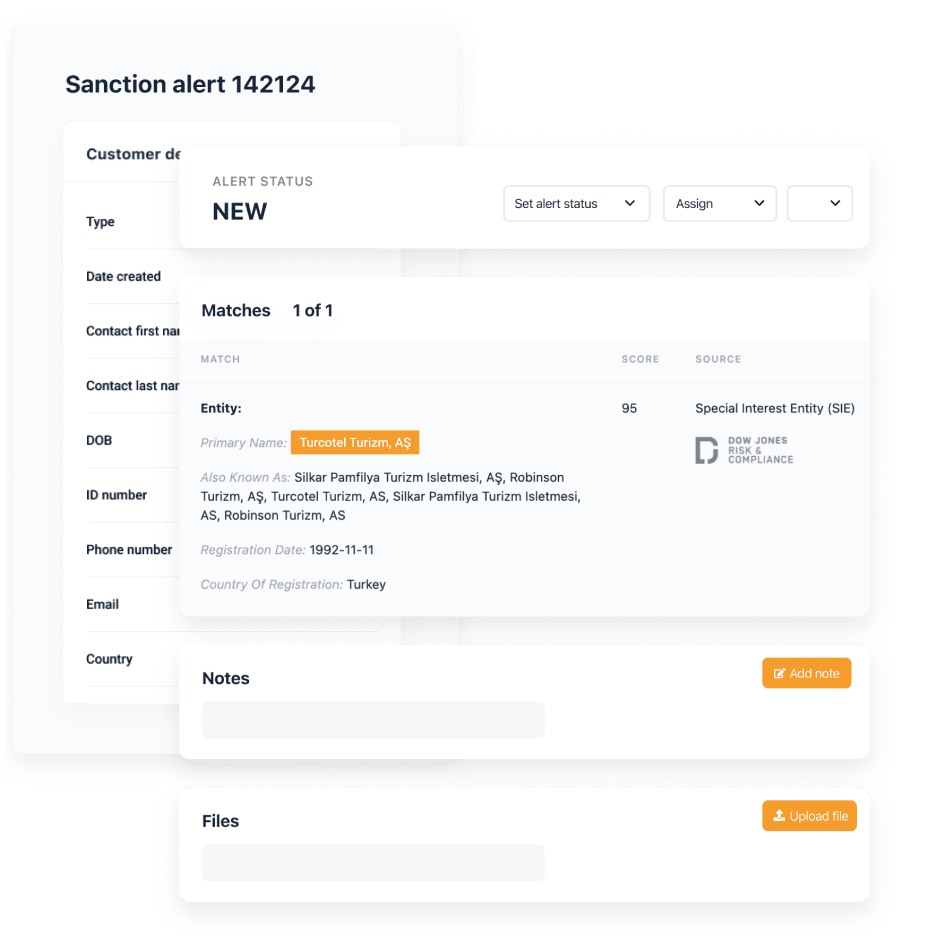

A new approach to sanctions screening

Salv introduces a user-centric, customisable approach to sanctions screening. With Salv, you can screen both customers and transactions against sanctions, PEP, and adverse media lists, irrespective of the number and complexity of data fields. You can access both customer and sanctions alerts in one page and resolve multiple alerts with a single decision.

There are additional features that you are unlikely to find in conventional sanctions screening software.

Consolidated view of global sanctions lists

You can set up and configure the screening process any way you want. A consolidated view of global sanctions lists allows you to set up sanctions lists, person re-screening, fuzzy matching, and BIC length without the hassle of waiting to hear from your provider.

All sanctions lists in our system are configurable and can be switched on and off as desired, depending on your organisation’s jurisdiction and governing bodies. To give a few more examples, you can add or remove sanctions lists, check and uncheck screening parameters, tune prefixes, and play around with fuzzy thresholds for different screenings.

Dow Jones Sanctions Control & Ownership data

At Salv, we use Dow Jones Sanctions Control & Ownership data. Dow Jones collects comprehensive ownership and control data available from public sources, such as company reports, including beneficial ownership information about the subsidiaries.

Custom screening lists

You can add, remove, or edit your internal screening lists in the platform using Salv’s advanced screening engine. Additionally, you can use API integration to automatically synchronise your screening lists between your system and the Salv UI, eliminating the need for additional list management.

Screening alerts search engine

To relieve operational burden and make screening search lightning-fast, our product engineer Tarmo developed the screening alerts search engine that changes everything. The screening alerts search engine works almost like a real-time search: it simplifies the process of locating and accessing screening alerts and frees up compliance agents to spend more time on investigating rather than reviewing.

We speed up alert handling time by automatically assigning alerts in the background. This way, available agents can quickly review the alerts and decide whether further investigation is needed or if the alert doesn’t represent a concern. This feature alone allowed one of our biggest customers, a leading banking service provider in Europe and the UK, to decrease alert handling time by 3x.

Multifunctional UI

Last but not least, Salv UI supports multiple flows and wraps around the core features like a candy wrapper, offering both aesthetic appeal and functional ease. It offers several viewing options: you can either use customer view or sanctions alerts view, so you can conveniently access and browse customer and transaction data we have screened. According to our screening logic, one transaction can generate multiple alerts. Alerts, in turn, can have multiple matches as well. With Salv, you can locate all alerts quickly on one page, often using one view alone.

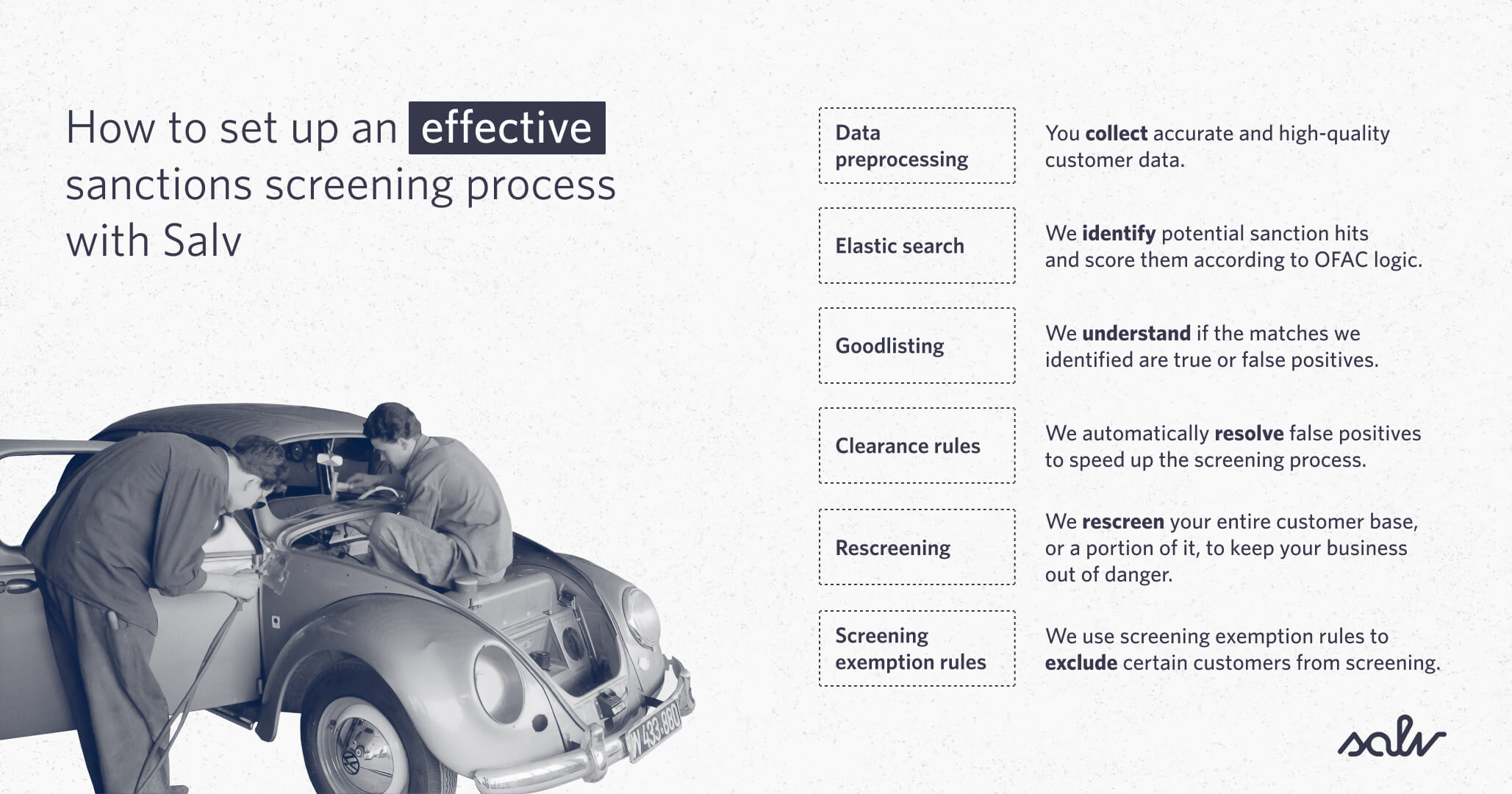

Sanctions screening process with Salv

We kickstart the process with data pre-processing. In order for sanctions screening to work as intended, you should collect and hand over accurate and high-quality customer data. Depending on your organisation’s needs and preferences, we can process and screen reference and transactional data.

Step 1: Pre-processing

During the pre-processing step, the data is converted to the same standardised format: lower case Latin script. Then we remove the redundant data that comes as part of the payment scheme. After this initial step is done, it’s time for Elasticsearch.

Step 2: Name matching

We use Elasticsearch to quickly search for name matches across all sanctions lists. With Elasticsearch, we can identify potential name matches and sanction hits and score them according to OFAC logic. It’s like looking up names in a phone book.

Step 3: Fuzzy matching

We use fuzzy logic to further narrow down screening results. Fuzzy matching allows us to identify all non-exact meaningful matches that contain sanctioned persons or entities. We generally use a fuzzy score from 0 to 100: a meaningful match is assigned a score between 95 and 100.

Step 4: Goodlisting

It’s an additional step that allows us to remove repetitive alerts, meaning that you will not get a new alert for the same person or transaction again, when exactly the same data fields are matched.

Step 5: Screening rules

At Salv, screening rules are used to automatically resolve false positive alerts. Our library contains dozens of pre-defined screening rules for person and transaction reference screening, transaction counterparty name screening, and transaction counterparty bank name or BIC code screening. You can change screening rules or add new ones, and test them on historical data as an additional safety measure. The whole process is clear, transparent, and fully auditable.

Step 6: Rescreening

With the unpredictability of new sanctions regimes, it’s important to be able to immediately identify and remove sanctioned subjects from your customer base. We do that with the help of rescreening. Rescreening is an additional step that helps us to make sure your business is not associated with any sanctioned persons or entities. We rescreen your entire customer base, or a portion of it, every morning, so you can sleep better and wake up when you want.

Step 7: Screening exemption rules

Screening exemption rules help you to exclude entities that you no longer need to screen, e.g., off-boarded customers. During the integration stage, you can test different configurations on historical data and choose the one that best works for you.

Challenges in sanctions screening process

Challenges within your sanctions screening process depend on how often sanctions lists are updated and how soon your compliance team can adapt to the changes. Your team must have access to the latest data, and make decisions quickly. But there are more challenges that can turn your sanctions screening programme into a living nightmare.

Growing number of false positive alerts

You may think that screening your entire customer base will give you a higher degree of confidence in the results. But, quite the opposite, over-screening can generate too many false positive alerts that will need to be reviewed separately to confirm they are not sanctioned.

Nowadays, many, if not most, of your false positives can be resolved automatically using sanctions screening software.

Rising operational costs

You need to have a clear understanding of who you want to screen and why. Over-screening creates higher operational costs, adding more burden and demanding more time and effort from your compliance team. Every sanction check increases the costs for the end users, which, in turn, creates more friction.

Customer friction vs. customer satisfaction

Customer friction is what ruins your customers’ experience with your business and takes away your opportunity to make a positive and lasting impact on your customers. Sometimes customer friction is something that just happens. But we know what can make it much, much worse:

✔️ Suspending your good customers’ transactions for sanction checks.

✔️ Leaving your customers in the dark about what’s going on.

✔️ Breaking hearts, not delivering on promises, missing deadlines.

As a result, you generate a lot of frustration and get some bad reviews (which would definitely take you off Santa’s nice list). With every bad review, you have to work harder. If you want your business to grow, you should prioritise your customers’ safety and convenience, and create a seamless customer experience.

Lack of cultural knowledge

In Estonia, alert hits between Estonian and Arabic names (Anu Tali vs. Abu Talib) are very common. Transliteration can be a big issue. Alert hits between company and personal names can create unnecessary confusion for compliance teams, unless your compliance agents are equipped with the knowledge, awareness, and understanding of different linguistic contexts.

Without a good cultural knowledge, your compliance team will struggle to properly review and investigate screening alerts. The same goes for your sanctions screening system. You must put a great deal of effort into training the model and improving the connections between the names and the screening logic. The language training is based on semantics, it takes time to get things right, so you should be prepared for a long slog.

Many language technologies predominantly focus on English, but Salv is now incorporating Eastern European transliteration in conjunction with Dow Jones data. This is crucial in the matching logic, especially when it comes to Eastern European name matching.

To get the best results from sanctions screening, you have to use every tool at your disposal. Instead of hastily selecting software, carefully assess your risks and consider all options.

As we continue to enhance our screening capabilities and align them with the expanding sanctions lists, criminals too continue to adapt and evolve. Sanctions screening is not a magic bullet. Clearly, there is more we can do to stop suspicious actors from abusing our systems. Combined with the right approach to transaction monitoring, sanctions screening can act as the ultimate shield against financial crime. It can completely transform your compliance as well as the way you do business. No more sleepless nights worrying about things that are out of your control. We got you covered.

Don’t wait until it’s too late: sanctions screening is something you can explore already today. Have a taste of sanctions screening with Salv and get everything you need to ramp up your sanctions compliance.