Crime-fighting blog

From time to time, we blog about our crime-fighting journey—our motivation, our path forward, and what we do to help you stop financial crime. Come join the discussion.

How financial crime collaboration infrastructure works in practice

How financial crime collaboration infrastructure works in practice, with lessons from Skype, Wise, and national intelligence-sharing networks across Europe.

The future of financial crime: Q&A with Dr Nicola Harding and Taavi Tamkivi

Key takeaways from a Q&A with Salv CEO Taavi Tamkivi and criminologist Dr Nicola Harding on the future of financial crime, covering APP fraud, intelligence s…

Confidence from clarity: bank-level financial crime compliance for lenders

Lenders are expected to meet rising financial crime compliance expectations. Here are the challenges they face and how they can be overcome.

Financial crime intelligence sharing: the missing link that breaks the fraud chain

Instant payments move money in seconds, but most fraud response workflows still take days. Here’s what our latest webinar revealed about breaking the fraud c…

Inside the daily reality of intelligence sharing: how Estonian banks collaborate to fight financial crime

Siiri Grabbi, Sanctions/CTF Officer at Coop Pank Estonia, shares her experience using Salv Bridge to support daily collaboration between banks.

Europe’s financial crime fighters are building a new collaboration model

Discover how financial institutions across Europe are building a new model for financial crime collaboration. From trust to structure, culture to law: this i…

How Latvia is accelerating financial crime intelligence sharing

How banks, regulators and fintechs in Latvia are building a trusted framework for intelligence sharing — learning from Estonia, and preparing for Article 75 …

The road ahead: How Salv is evolving screening, monitoring and risk

Discover how Salv’s AML compliance platform is evolving — from advanced screening and monitoring tools to AI-supported investigations and smarter risk scoring.

Financial crime trends 2025–2030: From fraud detection to real-time collaboration

Taavi Tamkivi outlines what the next five years of financial crime prevention will look like — from evolving fraud tactics to the rise of intelligence sharin…

From competition to collaboration: Building trust for intelligence sharing in financial crime

Trust is the foundation of successful intelligence sharing in financial crime prevention. Learn how banks and fintechs are overcoming competitive barriers to…

What financial institutions get wrong about intelligence sharing (and how to fix it)

Intelligence sharing is legal, technically possible, and increasingly encouraged across Europe — so why are financial institutions still hesitant? We explore…

Culture, not compliance: why financial institutions still struggle to share intelligence

Taavi Tamkivi explains why cultural barriers (not legal or technical ones) are the real reason financial institutions don’t effectively share intelligence.

A day in the life of a fraud investigator

What does a modern fraud investigation really look like? Follow a real-world case from alert to recovery and see how Salv Bridge changes the outcome.

Recommended reading for anyone working in fraud, AML or compliance

Fincrime expert Pallavi Kapale (Bank of China) shares a reading list she crowdsourced in a LinkedIn post — essential picks for anyone working in fraud, AML, …

Fighting fraud with empathy, not just alerts

Empathy might be our most overlooked fraud detection tool. Hear from Jodie Gayet, a reformed fraudster, on why insider fraud doesn’t just come out of nowhere.

Excited about AI in financial crime? Get your data ready first

An overview of AI in financial crime, looking at why you need your data infrastructure in order to succeed. Featuring insights from Taavi Tamkivi.

5 reasons real-time collaboration is changing fraud prevention

Five ways that real-time collaboration between financial institutions transforms how crime-fighters stop fraud. The key takeaways from a Salv webinar.

Financial crime collaboration that works: how FIs can beat scams together

See what happened when 300 fincrime professionals tackled real scam scenarios in Salv’s interactive webinar—and how financial crime collaboration saved the day.

Roundtable round-up: fincrime leaders’ vision of a collaborative future

A round-up of recent roundtables, sharing the key takeaways across three dinners where fincrime experts shared how the industry becomes more collaborative.

The Salv Bridge demo: real-time fincrime collaboration in action

Join our free webinar to see how collaboration and intelligence sharing in financial crime prevention works in practice — including a live demo of Salv Bridge.

Fighting financial crime through coordinated collaboration, not isolation

Better collaboration in financial crime prevention is often talked about. But how do we actually get started to stop more scams and protect more customers? T…

Join us for a collaborative fincrime roundtable in Copenhagen

Join us for an interactive roundtable event where you’ll uncover the tactics fraudsters use to help you fight crime more effectively. 11 March in Copenhagen.

Information sharing in fincrime prevention: what you might be missing

Information sharing is the missing piece in financial crime prevention. Learn how banks and fintechs can collaborate to stop fraud faster, reduce false posit…

Payment fraud prevention: How to follow the money and recover more stolen funds

Learn how financial institutions can collaborate in real-time to prevent payment fraud, recover stolen funds, and protect customers. Discover how Salv Bridge…

From theory to action: how to stop scams and catch more criminals

Financial institutions use intelligence sharing to recover funds lost to fraud. Join our webinar to learn how they do it.

Stop APP fraud with information sharing in 5 easy steps

Learn how you banks and fintechs can start sharing information to stop APP fraud. Protect your customers and recover stolen funds in 5 easy steps.

Instant payments and sanctions screening: real-time compliance tips for fincrime teams

Learn how financial institutions can comply with the EU’s Instant Payments Regulation (IPR). Get expert advice on real-time sanctions screening, customer dat…

Fight Night 2025: Frictionless Payments vs. Fraud Prevention

Join our webinar and learn how to integrate a perfect customer experience with financial crime compliance, ensuring a frictionless payment experience.

Shared intelligence webinar highlights: how fincrime teams can get ahead

Learn how criminals think, collaborate, and share intelligence with highlight from Salv and We Fight Fraud’s “Think Like a Fraudster” webinar.

Reducing fraud losses: How banks and fintechs can transform APP fraud recovery

Learn how banks and fintechs can reduce fraud losses by transforming their fraud recovery efforts through collaboration and real-time technology.

Think like a fraudster: how shared intelligence keeps fincrime teams ahead of the game

Join experts from We Fight Fraud and Salv as they discuss how fincrime teams are building resilient, collaborative networks that disrupt criminal strategies.

APP fraud detection and prevention tips from Thistle Initiatives

Get expert advice from Thistle Initiatives on combating APP fraud with people, process and technology tips that you can implement today.

AML solutions for fintechs: lessons from buiding in-house

AML solutions for fintechs: Learn the hidden pitfalls of in-house builds and why buying third-party tools may offer a better route.

How to optimise transaction screening: Fewer alerts, improved accuracy

Learn how to optimise transaction screening processes to reduce manual reviews, cut false positives, and improve alert accuracy without compromising compliance.

Instant payments and screening: clash or collaboration?

Join experts from Coop and Salv to discuss convergence of screening and instant payments, including real-time transaction screening under the IPR.

Webinar: how to do fuzzy matching when screening for sanctions

Join Salvers Kaur and Karl as they share how to make fuzzy matching work effectively when screening for sanctions. Watch the webinar.

How romance scams work: using dating apps to steal money

Learn how criminals use romance to build trust and launder money, based on a real-life fraud scheme.

In-house AML tools vs third-party software: a 2-minute overview

Explore the pros and cons of in-house AML tools vs third-party software. Learn why many AML teams choose to buy over build for screening and monitoring.

Social engineering in action: how bank impersonation scams work

Learn how bank impersonation scams use social engineering to mislead victims. A real-life example from fraud expert Tony Sales.

Prepare for takeoff: how to successfully implement a new AML solution

Learn how to successfully implement a new AML solution: from data mapping to go-live support, ensure a smooth transition with expert tips from Salv.

Improving fraud recovery: A quick Q&A with James Dodsworth

In this interview, James Dodsworth from Thistle Initiatives talks about what to expect from our upcoming APP fraud recovery webinar. Watch the interview now.

Webinar: Reduce sanctions screening alerts to <0.1%

By identifying and automatically resolving low-risk alerts, you can reduce sanctions screening alerts to <0.1%. You can watch the webinar on Salv’s website.

Beyond prevention and detection: the essentials of APP fraud recovery

Join Salv and Thistle Initiatives, an award-winning compliance consultancy, as we discuss innovative strategies to recover funds lost to APP fraud.

Marketplace fraud: The start of a sophisticated criminal scheme

More than a third of Facebook Marketplace ads may be scams. Learn how marketplace fraud works, based on a real victim story told by ex-fraudster Tony Sales.

Webinar takeaways: overcoming barriers to fincrime collaboration

Payments fraud and intelligence sharing takeaways from Monzo Bank, Salv, Skipton Building Society and We Fight Fraud.

APP fraud: The finance industry’s millennium bug moment

Reimbursement for APP fraud is changing UK fincrime. Dr. Nicola Harding explains how improved collaboration can tackle this threat.

Lithuania’s latest AML and data sharing rules: key insights

See how Lithuania’s Aug ‘24 AML and intelligence sharing rules help financial institutions combat financial crime more effectively.

Knowledge is Armour: Intelligence Sharing to Fight Financial Crime

A fincrime webinar where experts will discuss how to start collaborating more effectively with intelligence sharing to fight financial crime.

What voluntary reimbursement rates reveal about APP fraud

UK APP fraud reimbursement data gains attention in the FT. Taavi Tamkivi, Salv’s CEO, shares what it shows us.

Crack the safe code and win a pair of Apple Airpods Pro

Visit Salv at the Enterprise Estonia 8A180 stand. Crack the safe code and win a pair Apple Airpods Pro. Hints inside!

Lithuania removes information sharing blocks for banks and fintechs

Amendments to the Lithuanian AML law allow banks and fintechs to identify and detect criminal activity through information sharing.

Five ways fintechs can fight APP fraud with information sharing

Is information sharing the key to fighting financial crime? Discover five ways fintechs can combat APP fraud and aid police in catching criminals.

The collaborative investigation experience of Salv Bridge

Salv Bridge for collaborative investigations: community-powered response to APP fraud, money muling, sanctions evasion.

Information sharing: the UK’s best weapon against APP fraud

Collaboration and information sharing effectively detect app fraud in instant payments due to the rapid response time and transparency.

Practical use cases of generative AI in AML compliance

Discover practical uses cases of generative AI in compliance - to produce more accurate rules and reduce false positives, prioritise and review alerts.

Improve fraud detection with real-time transaction monitoring

Real-time transaction monitoring is not just a new fancy term; it can enhance your anti-fraud defences and help stop fraud in instant payments. Discover how.

Salv alternatives & competitors

Salv enhances sanctions screening and fraud risk management through collaboration. Let’s examine Salv alternatives & competitors and what they do differently.

ComplyAdvantage alternatives & competitors

ComplyAdvantage leads the way in perpetual KYC (pKYC) and real-time transaction monitoring. We take a closer look at ComplyAdvantage and potential alternatives.

Strengthening three lines of defence (3LOD) in banking

The three lines of defence (3LOD) model is a crucial tool in banking risk management. Read on to learn how you can strengthen your compliance strategies.

10 Best information sharing tools for financial institutions

Information sharing tools enable real-time detection of fraud through responsible collaboration. Legal frameworks are already in place to make it reality.

Cifas alternatives & competitors

Cifas is the UK’s leading fraud prevention service. Looking for more? Outside of the UK? Learn more about Cifas alternatives including Salv Bridge.

13 Best fraud detection software solutions in 2024

APP fraud remains a growing concern for regulated firms. Learn how to choose the right fraud detection software ahead of the PSR’s mandatory fraud reimbursement

The definitive guide to combating authorised push payment (APP) fraud

APP fraud requires urgent action from UK regulated firms ahead of mandatory fraud reimbursement coming in 2024. Learn how you can recover up to 80% of funds.

Creating our values, part 4: creation and the big reveal

Exploring the journey of creating Salv’s values, from buildup to the final reveal. Our core values underscore every action and decision we take.

Creating our values, part 3: a year of buildup

What would the world miss if Salv didn’t exist? Why should people join Salv? What is the DNA of a Salver?

Creating our values, part 2: how Budapest set the foundation

We built a remote-friendly environment where you can learn and improve, and create the impact that will be deeply felt throughout the company.

It’s time to streamline your RFI process

Let’s end the harmful practice of processing RFIs via email (or multiple customer portals, which can be equally time-consuming).

Interview with Ray Blake: financial crime and cost of compliance

Ray Blake talks about the financial crime landscape in the UK, emerging regulatory changes, and how much it costs firms to stay compliant.

Best KYC software and tools

The right KYC software can be a game changer for your business. What technology, software, and tools can make your life easier this year?

The year of collaborative crime-fighting (in review)

Reflecting on a year of growth and progress at Salv: hear from Taavi Tamkivi about our achievements, industry milestones, and community impact.

Creating our values, part 1: why culture isn’t just a buzzword

The stronger the culture, the less corporate processes a company needs. Our core values guide us in all our decisions.

Augmented compliance: interview with Baptiste Forestier

Baptiste Forestier, chief compliance officer at LinkCy, on finding the best balance between compliance and business.

The complete guide to sanctions screening

With sanctions screening, you can identify and mitigate sanctions exposure and support your compliance team.

Collaborative crime-fighting celebrates its 1 year anniversary

Enabling collaborative crime-fighting: join Salv Bridge’s journey with Europe’s top banks - 2,750+ cases solved in just one year.

Working at Salv: Kairi, the voice of people

Kairi Pauskar helped build Salv’s unique company culture, and made sure that everyone onboard shares the same values.

Good old startup culture doesn’t last forever – does it?

Companies don’t really change for the better. But Salv’s unique startup culture sets us apart from others. What makes us different?

A guide to effective transaction monitoring

You can turn transaction monitoring into a powerful tool to maintain compliance and fight financial crime. Learn how.

Screening alert search engine: a better way to access alerts

Follow the evolution of our screening alert backlog into a powerful screening alert search engine: search and access alerts like a pro.

What is collaborative crime-fighting?

What unites collaborative crime-fighting and information sharing and how we can use it to tackle financial crime – as an industry.

16 biggest fintech events and conferences in Europe in 2024/2025

Some of the biggest fintech events in Europe including Financial Crime 360, Money20/20 Europe, and MoneyLIVE Summit.

Public-private and private-private information sharing to combat financial crime

We look into ways to detect and disrupt financial crime through public-private and private-private information sharing.

What is financial crime?

The most common financial crimes are money laundering, terrorist financing, fraud, bribery, and corruption.

Salv Bridge Estonia pilot outcomes

Salv Bridge opens a new chapter in collaborative investigations of fraud, money laundering, and sanctions.

Feature development at Salv: data upload case study

Feature development at Salv: explore a data upload case study for improved product engineering and user experience.

Working at Salv: Stiven, business development wizard

Stiven shares his journey to a career in business development and sales. His philosophy is simple: take action.

The next big trend in AML: counterparty monitoring

Monitoring, detecting, and investigating money laundering and fraud just got easier with counterparty monitoring.

Working at Salv: Artjom, product engineer

What does it mean to work for a startup? Artjom Vassiljev shares his experience of product engineering at Salv.

Top movies and TV shows about money laundering and fraud

We created a list of the top TV shows and movies to advance your knowledge of money laundering and fraud.

15 Best AML software solutions 2024/2025

What software does AML use? Have a look at our selection of top AML software for banks and fintechs.

To hack or not to hack? Security hackathon at Salv

Join us in the security hackathon journey at Salv, where engineers analyse, test, and resolve our product vulnerabilities.

100 million reasons to celebrate – AML Platform’s big 2021

In 2021, our clients chose Salv’s KYC, sanctions screening, transaction monitoring and risk assessment functions.

AML Bridge: celebrating 100 investigative collaborations

Banks report significant loss reduction amid the rising volume of collaborative investigations, thanks to Salv Bridge.

The key to battling FinCrime? Collaboration and speed

Tiina Hiller shares key takeaways from the FinCrime Experts Meetup that Salv hosted jointly with Lithuanian AML Centre of Excellence.

Why haven’t we solved money laundering yet?

Money laundering is a curse of the digital age. Criminals launder an estimated €4tn every year, much of which goes to fund drug trafficking and terrorism.

Salv engineering key principles

Explore Salv’s engineering principles: real problems, customer focus, and continuous improvement in mission-driven work.

Celebrating Data Protection Day

GDPR regulation can actively help us meet AML/CFT goals, and our AML Bridge project plays a major part too.

AML Bridge pilot update – December 2020

Salv is building a decentralised network for sharing anti-money laundering (AML) intelligence between the banks.

Best financial crime podcasts to strengthen your AML game

Discover top financial crime podcasts: Dark Money Files, Bribe Swindle or Steal, Financial Crime Matters, The Perfect Scam. Tune in for insights.

Why our first customer at Salv was fake

We needed a dataset to test real-life transaction monitoring scenarios. Our team of data scientists had to get creative.

Building Salv’s identity, part 3: developing the brand identity

Discover the evolution of our visual identity, how it all came together, and how it helped us to build a memorable and recognisable brand.

Building Salv’s identity, part 2: producing the design

Jaanus Kase talks about visual aspects, including logo design, that helped develop Salv’s unique brand identity.

Building Salv’s identity, part 1: history, mission & name

Our purpose at Salv is to stop financial crime. How did it help us develop our mission and identity?

Working at Salv: Raido, product engineer

Meet Raido Türk, a product engineer at Salv. Read how Salv’s great company culture helps Raido grow and follow his dreams.

5 ways to beat financial criminals at their own game

To stay ahead of financial criminals, we must adjust our technology and stay on track with the mission.

Working towards a mission changes everything

Money laundering is a massive issue. Our dream at Salv is to stop it once and for all. What helps us stay focused on our goals?

Creating the environment we want to work in

Salv’s company culture is built on our mission and values. We fight financial crime to make the world a better place. And we do it together.

Working at Salv: Tarmo, product engineer

Meet Tarmo Kalling, a product engineer at Salv. Read how Salv’s great company culture helps Tarmo achieve new heights in his career.

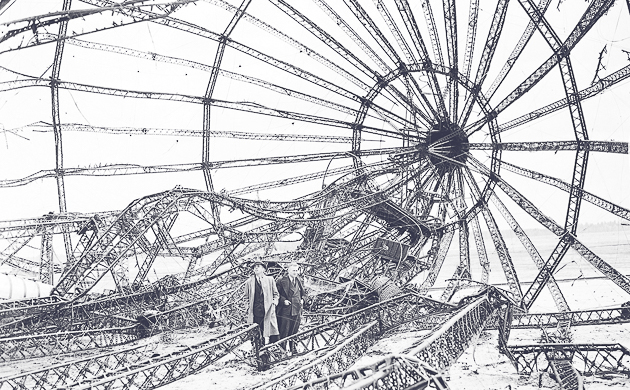

How AML crises can make our future brighter

How Danske bank scandal strengthened the anti-money laundering (AML) community and what we can learn from it.

Measuring your AML: Compliance

Struggling to set your AML metrics, especially when it comes to how effective your compliance is? It’s not as hard as you think. We promise.

There’s a reason you can’t keep up with AML regulations

Increasing regulations doesn’t reduce the number of anti-money laundering (AML) scandals. But we know what does.

How to improve your anti-money laundering controls

Technology enables financial criminals to get ahead of the law. How can compliance teams keep up and beat the bad guys?

Measuring Your AML: Compliance costs

Struggling to set your AML metrics, especially when it comes to how much your AML is costing your business? It’s not as hard as you think. We promise.

Why machine learning won’t save AML

Machine learning and AI have been hailed as the saviors of anti-money laundering technology. But not so fast. It can be way more dangerous than you’d think.

Measuring your AML: Customer impact

Struggling to set your AML metrics, especially when it comes to how your AML impacts your customers? It’s not as hard as you think. We promise.

Measuring your AML: Crime-fighting effectiveness

Struggling to set your AML metrics, especially when it comes to how well your company actually fights crime? It’s not as hard as you think. We promise.

Why we couldn’t ignore AML

Compliance, at first, sounded both intimidating and dry. But when I began to learn about AML, I discovered it was anything but. And I couldn’t ignore it.

Why you should choose a job that makes a difference

If you’re looking for a startup job, you might be tempted to choose the trendiest company. Instead, opt for one that makes the world a better place for us all.

Building your own AML compliance: what you need to know

Building your own Anti Money Laundering (AML) Compliance from the ground up isn’t easy. I know, because I’ve done it for a fast-growing global startup.

.png)

.png)

.png)

.jpg)

-d30192.png)

.jpg)